Sugar rises. Why sugar has risen in price: the version of the Ministry of National Economy. Warning signals from the economy

Source: Informburo.kz

The story received a new twist when Russia sent a proposal to the EEC to classify sugar as a product not subject to the customs procedure of a free customs zone and as a product for which the “free warehouse” rule does not apply. The initiative is aimed at redirecting the purchasing capacities of Kazakhstani business to the products of Russian factories due to the surplus of domestically produced sugar in Russia.

According to Russian industry representatives, this will help level the economic conditions within the EAEU, continue to work to remove restrictions in the countries importing Russian sugar, and will contribute to the development of agricultural production of sugar beet and the growth of the country's export potential.

According to Russian experts, exports in the country increased 5 times over the year - up to 540,000 tons, which became a historical maximum. The main importer of sugar is Kazakhstan, where 122,000 tons of products were delivered last year.

As a response, Deputy Prime Minister - Minister of Agriculture of the Republic of Kazakhstan Umirzak Shukeyev recognized the need to abolish the exemption for sugar imports from the EAEU countries. The official noted that otherwise Russia and Belarus would destroy Kazakh sugar producers.

Thus, the problem in the sugar market of the EAEU countries dragged on. The reason for the litigation was the proposal of Russia to ban the placement of sugar in Kazakhstan under the customs procedures of a free customs zone and a free warehouse.

Since the end of 2017, the Russian side has also been actively discussing the initiative to cancel the benefits of the Republic of Kazakhstan for the import of white sugar from third countries. For example, in 2017, sugar factories in Russia produced about 6.2 million tons of sugar with the country's domestic consumption of 5.8 million tons - a surplus of more than 400 thousand tons.

In the current situation, it is worth noting that Kazakhstani business has the entrepreneurial freedom to choose business partners, since there are no agreements on a coordinated economic policy between the Russian and Kazakh parties regarding sugar, both within the framework of bilateral relations and on the EAEU platform.

However, Dana Zhunusova, Deputy Chairman of the Board of NCE RK Atameken, commenting on the situation, noted that the use of sugar benefits by the Kazakh side does not contradict the obligations of the Republic of Kazakhstan to international partners and does not have a negative impact on the EAEU sugar market.

What measures is the Ministry of Agriculture taking today to resolve the conflict of interests of different states, the department answered Informburo.kz.

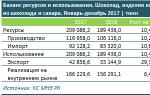

According to the Ministry of Agriculture, in 2017, the volume of sugar imports to the republic amounted to 182.8 thousand tons, of which 85% or 155.3 thousand tons are imported from the EAEU countries (Russia and Belarus). At the same time, about 50-80 thousand tons of sugar are imported annually by the owners of free warehouses for processing. In 2017, they imported about 15% of preferential products from the total volume of sugar imports from third countries, again, a significant share of sugar is imported from the EAEU countries.

click,

to turn on the sound

The ministry explained that the implementation of investment projects for the deep processing of wheat can be influenced not only by the duty-free import of sugar, but also by other factors.

However, no one leaves entrepreneurs in trouble. As it turned out, within the framework of the state program for the development of the agro-industrial complex for 2017-2021, domestic agricultural producers are provided state support for the development of the sugar industry by subsidizing the purchase of sugar beet seeds, mineral fertilizers and plant protection products, the purchase of agricultural equipment, through the payment of subsidies for one ton of sugar beet, handed over for processing to the sugar factory.

“In Kazakhstan, the average consumption of sugar per year is about 500,000 tons, of which 90% of the needs of the domestic market are provided by processing imported raw cane sugar and importing finished sugar, 10% - by processing domestic sugar beets. Within the framework of the state program for the development of the agro-industrial complex for 2017-2021, in order to increase the competitiveness of domestic production, measures of state support are provided to sugar factories, confectionery factories by reimbursement of part of the costs (30%) of the investments invested in the modernization of production. Measures are also being taken to provide processing enterprises with raw materials by subsidizing agricultural producers for a ton of sugar beets handed over for processing,” the Ministry of Agriculture commented on the measures taken to protect domestic producers.

In Kazakhstan, at the same time, they plan to expand the sown area of sugar beet to 32,000 hectares, which will make it possible to meet the domestic demand of the country with domestic raw materials up to 30%.

“The state policy is aimed at the development of domestic sugar production, and in order to achieve the goals and objectives for the development of the sugar industry, approaches will be considered taking into account the influence of external factors. We also note that there have been no official complaints from entrepreneurs to the Ministry of Agriculture,” the ministry added.

According to the analysis of the data of the Statistics Committee of Kazakhstan, the production of sugar and molasses in January 2018 decreased over the month by 12.21% and amounted to 41,854 tons (in December 2017 - 47,677.0 tons). In January 2017, Kazakhstan produced 38,635 tons, and in January 2016 - 35,472 tons.

At the same time, the Union of Food Enterprises of Kazakhstan (SPKK) explained that the import of raw cane sugar can be carried out only after obtaining permission from the Ministry of National Economy. At the same time, the Government of the Republic of Kazakhstan guarantees that raw sugar imported for industrial processing, as well as white sugar, will not be redirected to the territory of Russia and Belarus.

“The mechanism of customs and tariff regulation currently applied in the EAEU countries in relation to the import of raw sugar was developed in order to ensure conditions for equal competition for beet sugar compared to sugar from imported raw sugar, as well as to maintain the price of sugar in the domestic market of the EAEU countries at level equivalent to 700 US dollars per ton. This is ensured through the application of a floating rate of import duty on raw cane sugar (from 140 to 250 US dollars per ton), depending on the level of the world exchange price," the experts of the SPPK said.

However, when importing white sugar in the EAEU countries, a customs duty of $340 per ton is applied. Whereas in the EU countries the customs duty is 419 euros per 1 ton.

The SPPK believes that if the current benefits are maintained by domestic enterprises, the damage will primarily be inflicted in the social sphere. As for consumers, there is only one problem - the cost of the final product.

“The end of the quota for the import of raw sugar (in 2019) with exemption from paying customs duties will lead to an increase in market prices in the absence of a competitive Kazakhstani product (sugar shortage, and then a massive import of products manufactured by the CU countries). This will lead to the fact that more than three thousand people will lose their jobs, therefore, social tension will increase, and the budget will lose hundreds of thousands of taxes,” the union added.

As explained in the union, Kazakhstan has been preparing for the abolition of this category of benefits for several years already.

At the same time, the initiative of the Ministry of Agriculture to expand the sown area of sugar beet will lead to an increase in production volumes by 3.5 times. In addition, the modernization of existing and construction of new sugar factories is envisaged, which will increase the output by more than 3 times, as well as create up to 300 new jobs.

At the end of October 2017, a phased technical launch of the production lines of the Aksu sugar plant was carried out. This is Aksu Kant LLP with a planned processing capacity of 350 thousand tons of sugar beet after the modernization of the plant. The total amount of investments is about 15 billion tenge, of which 3 billion tenge is the leasing of the main equipment from NC SEC Zhetisu JSC.

Regarding the final decision on the abolition of benefits, Informburo.kz sent a request to the Ministry of Investment and Development of the Republic of Kazakhstan, but we are still waiting for a response.

Special economic zones and free warehouses are a special regime that is created in order to develop competitive industries, attract investment, new technologies in the economy and regions, as well as increase employment.

In October 2017, confectioners asked Prime Minister Bakytzhan Sagintayev to protect their interests in the Customs Union due to the initiative of sugar producers in Russia and Belarus to ban sugar imports into the territory of the Customs Union.

And a month earlier, the Minister of National Economy Timur Suleimenov said that if other countries in the EAEU put up barriers to Kazakh business, the answer would be immediate. This is how he commented on a possible ban on sugar exports to Russia.

In January, sugar fell in price by 3%, caramel and sweets - rose in price by 0.2-0.3%, Energyprom analysts write.

In the first month of this year, confectioners of the Republic of Kazakhstan produced more than 7 thousand tons of sweets at once - 10.5% more than in the same period a year earlier.

The largest volumes of production are concentrated in Almaty - 54.8% of Kazakhstan, 3.9 thousand tons, immediately + 26.1% per year. The giant of the "sweet" industry of the Republic of Kazakhstan, the "Rakhat" factory, works here.

Also among the leaders is Kostanay region (34.8% of Kazakhstan, 2.5 thousand tons, slightly less than in January 2017, minus 1.5%). Another largest company in the sector, Bayan-Sulu, operates in the region.

Another 4.3% of production fell on the South Kazakhstan region (the branch of JSC "Rakhat" - "Rakhat-Shymkent" operates here) and 4% - on the Almaty region (among the large producers of the region - for example, Khamle LLP).

Last year, local producers provided 55.9% of the demand for sweets.

It is noteworthy that sales volumes in the domestic market of the Republic of Kazakhstan increased by only 6.4%, while exports grew by 29.3% at once.

So, for example, Kazakhstani sweets, as well as other foodstuffs from the Republic of Kazakhstan, will soon appear on the windows of retail chains in the Urals and the Volga region. Chelyabinsk community members, representatives of the Ural Economic Union, initiated the project under the working title "Kazakhstan". The ultimate goal is the opening of a federal network of stores with Kazakh goods.

We are talking about creating a joint venture, where the partners will have equal shares. A warehouse already exists, and such warehouses should first appear in the Urals (Tyumen, Yekaterinburg, Perm, Magnitogorsk and Chelyabinsk), and then a new distribution network will stretch from Moscow to Novosibirsk.

In the domestic market, at retail points of sale, fruit and berry caramel rose in price by 0.3% per month, and by 9.8% per year, to 650 tenge per kg in January 2018.

Other sweets not glazed with chocolate increased in price by 0.2% per month and by 10.4% per year, to 978.1 tenge per kg.

It is noteworthy, at the same time, that granulated sugar fell in retail prices by 3% over the month and immediately by more than 20% over the year.

Last year, Russia, despite the consequences of the financial crisis, imported volumes of sugar that puzzled even the world's suppliers of this product. As early as the summer of 2000, tense tendencies began to emerge on the Russian sugar market. However, the sharp rise in prices was soon stopped. But, apparently, the Russian sugar market today is not immune from major changes.

Vasily Severin, Chairman of the Board of the Union of Sugar Producers of Russia, said that this year the production of sugar from sugar beet in our country will remain at the level of 1999 and will amount to 1 million 570 thousand tons. At the same time, he had in mind the fact that this year the area under sugar beet crops decreased by 90 thousand hectares (to 810 thousand hectares). And this is easily explained. Growing beets today has become unprofitable because it does not generate income. At the same time, its yield this year brought a small surprise to sugar producers, having increased by an average of 10% compared to last year, when 184-185 centners per hectare were harvested. But this in no way means that the production of the final product will increase, since almost half of the crop today is lost during harvesting and transportation.

Nevertheless, as Vasily Severin noted, there are no interruptions in sugar supplies to Moscow so far. But in the current season, nevertheless, apparently, there will be a need for additional purchases of beet sugar.

It should be reminded that the auction scheduled for October for distribution of quotas for raw sugar imports was postponed by the government to the beginning of December. According to experts, the delay will certainly adjust the price of sugar upwards. But already now the government is actively discussing ways out of this situation. One of them involves the abolition of the tariff quota and a return to the protection of the domestic sugar market with the help of duties. As you know, on December 16, the 40% seasonal duty on raw sugar expires. Accordingly, from the same moment, it is proposed to increase the basic customs duty on raw material in fact three times - from 5 to 15%.

However, it is still unknown how much these measures will contribute to the rise in the production of sugar from our own beets. In the opinion of sugar refiners, this year's sugar production in Russia will, at best, slightly exceed 1.3 million tons, since already now the stocks of raw materials at the plants are practically minimal.

In general, the sugar market today is adjusted upwards in prices. However, this has already been felt by consumers, since the retail price of granulated sugar has recently increased significantly.

The increase in the price of sugar in stores continues, despite the end of the beet processing period. He became one of the leaders in price growth this year, adding almost 20 percent by mid-November.

Increasing supply in the fall usually drives down prices, which rise in the spring and summer. But this year it didn't happen. Mostly because of the depreciation of the ruble, experts say. And they warn that after a slowdown in price growth at the end of this year, the rise in price will continue in the spring of 2015.

Beet sugar production this season will be at the level of last year or even slightly more. At the same time, despite the fact that all beets are domestic, sugar prices are growing along with the dollar, says Yevgeny Ivanov, a leading expert at the Institute for Agricultural Market Studies (IKAR).

According to him, this is due to the fact that a significant part of the production costs are clearly tied to imports - seeds, chemical protection products, loans, agricultural machinery, and equipment. The relationship is direct.

“Plus, there is an indirect connection. In Russia, when the ruble weakens, all export goods automatically increase in price. If the domestic price does not suit the manufacturer, he will simply export everything. Many Russian goods become more expensive because of this. expert.

It is as follows. If there is no reason, it is difficult for the manufacturer of any product to justify a price increase to the buyer and the state. And then there was a reason - the devaluation of the ruble. All manufacturers use this, even with a margin. Then it will be more difficult to do so. And now it's still possible. There seems to be no reason right now for the price to rise so quickly. But then it will be more difficult to lift it.

There is a lot of sugar on the market now. But producers, taking advantage of the weakness of the ruble, found a reason to raise prices

Russian exports, according to IKAR, do not affect the domestic sugar market. Its volumes are microscopic - up to 10 thousand tons per season. In recent years, we have been producing 4.5-5.0 million tons of sugar. We consume more than 5.6 million. At the same time, our sugar is quite expensive by world standards.

“Now wholesale prices have begun to decline. They have been going down since November 12. This is facilitated, firstly, by the fact that sugar has risen in price and so much more than it should. And secondly, this is a reaction to the strengthening of the ruble,” Ivanov notes. He adds that there is a lot of sugar on the market now. But so far, prices have come down slightly. “It can be expected that the decline will continue for at least 1-2 weeks. It may last until the end of the year,” says the interlocutor of RG. “But we are unlikely to see the consequences of a decrease in wholesale prices on the shelves. are growing."

And next year we are waiting for a new wave of price growth, the expert is sure. It will be related to the fact that we do not have enough domestic production, and we must import sugar. It will take about a million tons. “Belarusians will supply us with about 400,000 ready-made sugar. Moreover, buying it is less profitable than raw sugar. But this is an agreement between the countries. .

Purchases of raw will fall on the period from November to July. Sugar prices will rise later as accumulated stocks are reduced. In order for the profitability of raw material supplies to be positive, wholesale prices will have to rise from 31 rubles per kilo to about 36-37 rubles. This is provided that the exchange rate of the ruble against the dollar will be kept at the current level.

If the ruble falls, then the rise in price will be more than these 20 percent,” Yevgeny Ivanov predicts.