How to take the main remedy in 1c. Accounting info. Receipt of fixed asset item

At the beginning of the article, let me remind you that fixed assets include property worth more than 100,000 rubles for tax accounting purposes (this criterion comes into force for objects put into operation starting from January 1, 2016) and 40,000 rubles for accounting purposes. Let's look at the step-by-step instructions for purchasing and capitalizing fixed assets in 1C 8.3 Accounting (the instructions will also be relevant for 1C 8.2).

Purchase of fixed assets

The receipt of fixed assets in 1C 8.3 is documented in a document with the type of operation Equipment(menu Purchases – Receipts (acts, invoices)):

or document Receipt of equipment(menu Fixed assets and intangible assets – Receipt of fixed assets – Receipt of equipment):

essentially the same thing - only the document logs look different.

On the Equipment tab of the document that opens, add a record with the item of item that was purchased by the organization:

At the same time, I note that it is necessary to enter the fixed asset in the Nomenclature directory in advance:

Let's generate a report on transactions to the document:

Get 267 video lessons on 1C for free:

As you can see, account 08.04 reflects the cost of the fixed asset, and account 19.01 reflects VAT on the acquisition of fixed assets.

I note that in the case where a fixed asset was acquired for an activity not subject to VAT, the amount of VAT is included in the initial cost of the fixed asset. This should be reflected in the purchase document settings:

It is important to consider that VAT on the purchased fixed asset will be reflected in the purchase book only after the fixed asset has been accepted for accounting and only if it has been. In the Equipment Receipt document, the incoming invoice, as in all Receipt documents (act, invoice), is registered after specifying the invoice number and date by pressing the button Register:

After the Register button has been clicked, the invoice field takes the form of a hyperlink:

After receipt of the fixed asset, you can.

Receipt of additional expenses

In the case when the acquisition of a fixed asset involved expenses that should be included in its initial cost, a document is entered into the system Receipt of additional expenses(menu OS and intangible assets – Receipt of fixed assets – Receipt of additional assets. expenses or based on a document Receipt of equipment):

In 1C 8.3, the receipt of fixed assets occurs as follows: through the main menu section of the OS and Intangible Assets panel, go to the Receipt of fixed assets section, where we select the subsection that corresponds to reflect the accounting transaction:

Next, according to the accounting rules, the fixed asset, in our example this is a Ford Mondeo car, needs to be transferred to the Dt of the account on 01.01. To do this, in the 1C rev.8.3 program, go to the subsection and create an accounting document:

We enter all the information about the transport and fill out all sections of the table, assign an inventory number:

After entering all the necessary information, we write it down, post the document and check the postings. According to accounting, the 1C 8.3 program correctly formed them: Dt 01.01 Kt 08.04 - the fixed asset is “registered”, that is, it is already registered with the enterprise:

Using SALT, we will check how the report reflects the availability and cost of a fixed asset:

Calculation of depreciation in 1C 8.3 - step-by-step instructions

Depreciation of fixed assets, according to the accounting chart of accounts, is accounted for in account 02 Depreciation of fixed assets. In paragraph 8 and paragraph 17 of PBU 06/01, all property is classified into groups. The initial cost of fixed assets is included in expenses through depreciation.

Depreciation on fixed assets in 1C 8.3 is accrued from the next month in which the fixed assets object was accepted. Depreciation will continue until the useful life ends or the cost is written off.

Depreciation is accrued in accordance with the depreciation group to which the fixed asset belongs: linear or nonlinear method. What method will be used to pay off depreciation should be reflected in the accounting policy of the enterprise.

According to accounting rules, a company's expenses for the acquisition of fixed assets must be written off gradually, in parts, towards the manufactured (produced) product or service. For these purposes, depreciation on fixed assets is calculated monthly.

In 1C 8.3, go to the OS Depreciation section:

When performing the Month Closing function in 1C 8.3, we open a routine operation, which reflects the calculation of depreciation - partial monthly expenses required to be written off against the cost of manufactured products or services:

Through Help - Calculation, select the desired section:

We check how 1C 8.3 Accounting calculated the amount of depreciation for the month:

To do this, we’ll make a table to make sure the calculations are correct:

All amounts coincide, which means that information about the fixed asset was entered into the 1C 8.3 database correctly and, in accordance with the accounting policy of the enterprise, the 1C program made the necessary calculations for accounting and tax accounting:

We also check for NU purposes the calculation of the depreciation bonus required when calculating income tax:

Using the SALT for account 02.01, we check the accounting:

We also check tax accounting by selecting the required element in the settings:

How to set the parameters of depreciation of fixed assets for accounting and financial accounting, as well as the procedure for including the cost of fixed assets in the cost of accounting and tax accounting in 1C 8.2 (8.3), see the following video lesson:

Write-off of fixed assets

Write-off of fixed assets in 1C 8.3 occurs as follows: select the subsection Disposal of fixed assets - the Write-off of fixed assets tab:

We create and prepare an accounting report:

We fill in all sections of the plate sequentially:

When all the data has been entered, you need to immediately check the accounting entries:

Thus, in 1C 8.3 the fact of write-off of the fixed assets was reflected in the accounting. Next, we create a printed form - Certificate of write-off of fixed assets:

We print it out and give it to the head and members of the commission to sign:

According to SALT account 91.02, we check the correctness of the reflection of the operation to write off a fixed asset for other expenses:

In the SALT account 01.09, the write-off of fixed assets was reflected, that is, at the end of the reporting period, the fixed asset was no longer listed in the enterprise:

How to correctly prepare accounting documents in 1C 8.3 is described in the Help section:

Sale and write-off of fixed assets in 1C 8.3

Before selling a fixed asset, for example a Ford Mondeo car, it is necessary to carry out the following accounting transactions:

- Conduct monthly closing of accounting entries to calculate depreciation;

- Fill out the document Transfer of OS for the buyer;

- Issue an invoice to the buyer based on the Transfer of Assets to reflect VAT;

- Reflect in 1C 8.3 the deregistration of vehicles from the State Traffic Safety Inspectorate for the correct calculation of transport tax;

- Check that the postings are formed correctly.

Open in the section Retirement of fixed assets the subsection Transfer of fixed assets:

We select the counterparty - the buyer and create an accounting document:

Sequentially fill in all sections of the table:

After entering the information and posting the document, we check the postings:

- Dt 62.01 Kt 91.01 – vehicles sold to the buyer;

- Dt 91.02 Kt 01.09 - transfer of vehicles is reflected in accounting;

- Dt 91.02 Kt 68.02 – VAT reflected:

We open the Certificate of Acceptance and Transfer of Fixed Assets, which records the recipient (buyer) and the deliverer (seller) of the vehicle and the make of the vehicle sold:

We print out the Act, sign it by both parties, give one copy to the buyer, and file the second in the accounting reports.

In 1C there are two options for registering the acquisition and accounting of fixed assets:

Standard, in which two documents are used:

- capitalization of OS - using a document Receipt (act, invoice) type of operation Equipment ;

- OS commissioning - using the document Acceptance of fixed assets for accounting .

Simplified, in which a single document is used:

- capitalization and commissioning of OS - document Receipt (act, invoice) type of operation Fixed assets .

When the commissioning of the OS is carried out simultaneously with the capitalization of the OS, then, of course, it is more convenient to reflect all operations in one document: use Simplified version. But it has some limitations.

The simplified option cannot be used if additional costs will be added to the initial purchase price of the fixed asset upon its acquisition.

How to accept an OS for accounting in 1C 8.3: standard method

With the standard method, two documents are drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Equipment ;

- document Acceptance of fixed assets for accounting ;

Let's consider the features of filling out each document and their implementation.

Document Receipt (act, invoice) type of operation Equipment

You can register the capitalization of fixed assets using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – Equipment section;

- OS and intangible assets – Receipt of fixed assets – section Receipt of equipment.

So, for example, in 1C Accounting 8.3 it is recommended to purchase a car that we plan to use on public roads through the standard option, because the initial cost of the car will include additional costs - in this case, the fee for its registration with the traffic police.

On the tab Equipment enter the purchased fixed assets and indicate their quantity. Select fixed assets from reference book Nomenclature.

When posting a document, the initial cost of a non-current asset will be taken into account in the “Purchase of components of fixed assets” account until it is entered document Acceptance for accounting of fixed assets.

Learn more:

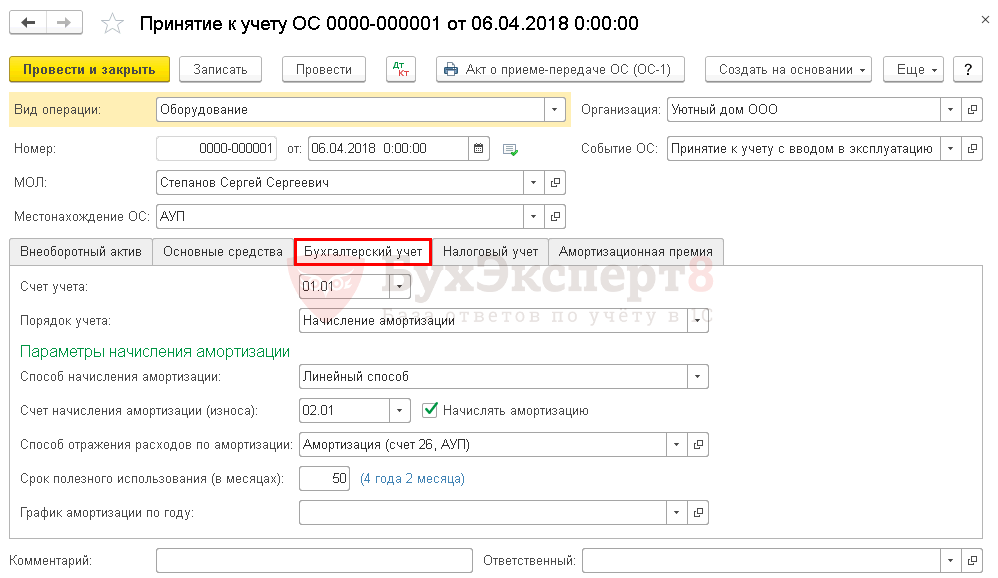

Document Acceptance for accounting of fixed assets

You can register a fixed asset using this document through:

- Fixed assets and intangible assets – Receipt of fixed assets – section Acceptance for accounting of fixed assets.

On the tab Non-current asset indicate the details of the acquired asset before commissioning:

- Equipment - non-current asset put into operation; select from reference book Nomenclature;

- Main warehouse - storage location of the registered object;

- Check- a cost account where the initial cost of an object is formed.

On the tab Fixed assets select the OS to be put into operation from the directory Fixed assets .

Set the parameters for calculating depreciation and paying off the cost of objects on separate tabs Accounting And Tax accounting .

On the tab Accounting please indicate:

- Account- accounting account put into operation of the OS;

- Accounting procedure

:

- Depreciation calculation;

- The cost is not repaid.

When selecting a value Depreciation calculation set the parameters for its accrual.

On the tab Tax accounting install .

Depending on the procedure for accounting for the costs of purchasing an object in the NU in the field The procedure for including costs in expenses can choose:

- Depreciation calculation- for fixed assets for which depreciation will be calculated;

- Inclusion in expenses upon acceptance for accounting- for objects, the costs of acquiring them at a time will be taken into account in expenses when accepting them for accounting;

- Cost is not included in expenses- for objects the costs of which will not be taken into account in expenses that reduce the tax base.

For NU it is impossible to select the depreciation calculation method in the document, because it is set in the accounting policy settings and applied to all OS objects. In 1C, the method is installed in the block Main – Settings – Taxes and reports – Income Tax section.

For objects for which depreciation is charged, it is possible to charge a depreciation bonus. Its parameters are set on a separate tab Depreciation bonus .

The document generates transactions:

Learn more:

- OS commissioning

- Acceptance for accounting of fixed assets not accounted for in NU

How to register an OS in 1C 8.3: a simplified method

With the simplified method, a single document is drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Fixed assets .

Document Receipt (act, invoice) type of operation Fixed assets

You can register a fixed asset using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – section Fixed assets;

- OS and intangible assets – Receipt of fixed assets – section Receipt of fixed assets.

In the tabular section, reflect the purchased objects from directory Fixed assets. It is not possible to indicate the number of objects in the document: only one item in the quantity of one object can be accepted for accounting. Add identical items of fixed assets to the directory Fixed assets separate positions and differentiate them according to certain criteria, for example, by workplace (WM).

According to the parameters for calculating depreciation and repayment of the cost of objects, it is possible to indicate only:

- Method of reflecting depreciation expenses in the document header - the same for all entered objects;

- Life time in the tabular part - the useful life, which is set to be the same for NU and BU, specifically for each object.

1C Accounting 8.3 itself in tax accounting determines the procedure for repaying the cost of the acquired object:

- if the cost of the object is no more than 100,000 rubles, the acquisition costs are included in expenses at a time;

- if the cost of the object is more than 100,000 rubles, then depreciation will be calculated according to the method established in the accounting policy for NU.

Regardless Accounts in the tabular part of the document, the costs of acquiring fixed assets will be automatically taken into account in the “Purchase of fixed assets” account, and then written off to Account, set in the document.

In the 1C 8.3 Accounting program, generate the receipt and acceptance of fixed assets for accounting.

Fixed assets are inventory assets worth more than a certain amount (constantly increasing) and whose useful life is more than a year.

Fixed assets include buildings, structures and other real estate, construction projects, equipment, power lines, pipelines and so on.

In the 1C 8.3 system, fixed asset accounting has several separate sections that contain all the necessary operations for full-fledged work on this topic:

- Section “Receipt of fixed assets”. In this section, documents on the receipt of equipment and additional items are created. expenses in 1C 8.3, which are included in the cost of fixed assets. Also in this section 1C the acceptance of OS for accounting is formalized.

- In the “Fixed Asset Accounting” section, you can create documents reflecting the movement, modernization and inventory of fixed assets.

- The section “Retirement of fixed assets” contains documents on the write-off and transfer of fixed assets.

- The section “Depreciation of fixed assets” is responsible for depreciation calculations and charges.

In this article, using a step-by-step example as a step-by-step instruction, we will look at the main operations related to accounting for fixed assets in 1C 8.3.

How to capitalize a fixed asset

Receipt can be in the organization (purchase of fixed assets) and in leasing. In this article, we will consider accounting for acquired fixed assets.

So, let's create a document for capitalization of the OS. Example of a completed document:

Receipt of additional expenses for the operating system

The initial cost of equipment and other fixed assets is formed at the acquisition stage not only from the purchase price, but also from installation costs and other expenses associated with the acquisition.

Therefore, it is worth considering two documents:

- Receipt of additional expenses

- Transfer of equipment for installation

You can create them in the section “Fixed assets and intangible assets” - Receipt of fixed assets. As usual, documents are created by clicking the "Create" button. In the header of the document, fill in the standard details - Organization and Counterparty.

In the tabular section, in the “Main” tab, the amount of additional costs is indicated:

On the “Products” tab, the fixed asset item is indicated, the cost of which includes these expenses:

Transfer to installation

In this document we will fill in the following details:

- Organization

- Stock

- Construction object

- Cost item

Let's add equipment to the table part:

The above documents must be created before the fixed asset is accepted for accounting.

How to register and put into operation an OS

We will show how the document is filled out; as a result of posting the document, the equipment moves from account 08.04 to account 01.01.

Non-current asset tab:

OS tab:

Depreciation in transactions will be charged to account 02.01:

Moving the OS to 1C

The movement of a fixed asset is very similar to the movement of goods, only the goods are moved between warehouses, and the fixed asset between departments (after all, we have already taken it into account).

When preparing a document, only the details “Accrual of depreciation” and “Method of recording depreciation expenses” may raise questions.

These details should be indicated if depreciation needs to be calculated after the move. We will leave them empty and charge depreciation at the end of the month:

Inventory of fixed assets

Inventory of fixed assets in 1C is practically no different from inventory of goods, only, again, instead of a warehouse we indicate a division (more information about goods in the article Inventory in 1C 8.3). In the tabular section, instead of quantity, we indicate the presence of a fixed asset:

If a fixed asset is not listed in accounting, but in fact it is, a document of acceptance for accounting is made based on the inventory, and vice versa, if it is actually missing, we write off.

Write-off of fixed assets

Here, in addition to the standard fields, we indicate the reason why the fixed asset is written off:

We will not post the document, since we will still need the fixed asset to consider the depreciation operation.

Depreciation of fixed assets

Calculation and recording of fixed assets depreciation is done using the month-end closing assistant. The operation is performed once a month and, as a rule, at the end:

To open the assistant, you need to go to the “Operations” menu, then follow the link “Closing the month“. The assistant window will open immediately. In it you need to select a period and organization. Then the assistant will do everything himself. All calculations in the assistant are made sequentially, and depreciation deductions are calculated first. If the operation went through without errors, a document for the routine operation “Depreciation and depreciation of fixed assets” will be created:

Let's see what depreciation postings 1C generated for us:

As you can see, the amount of depreciation on our machine was 731.45 rubles. Let's check the correctness of the calculation.

The machine was registered for 61 months. The initial cost was 44,618.64 rubles (excluding VAT, depreciation is not charged on the amount of VAT). Depreciation is calculated using a linear method, so to check, simply divide 44618.64 by 61. The result will be 731.45 rubles. The calculation is correct.

Based on materials from: programmist1s.ru

Fixed asset accounting is a section of accounting that concerns almost every institution. And sometimes even simple operations for accounting for fixed assets raise questions among accountants. In this article I would like to tell you how to reflect in accounting the fact of purchasing a fixed asset using the 1C: Public Institution Accounting 8, edition 2.0 program.

As you know, the purchase of fixed assets is not carried out directly to the accounts of group 101.00 “Fixed assets”. First, the fixed asset and the costs of its delivery, assembly and any other related costs are accumulated in the accounts of group 106.00 “Investments in non-financial assets” (if these are fixed assets that are actually already located on the territory of the institution) and group 107.00 “Non-financial assets in transit” "(if these are fixed assets that are in transit). It is not recommended to keep capital investments in fixed assets in accounts 106.00 for a long time, so that in the event of an audit, unnecessary questions will not arise. Although such situations are very rare in practice: the acquired fixed asset is most often immediately taken into account, except for long-term investments in capital construction.

Section dedicated to working with fixed assets in the program “1C: Public Institution Accounting 8, edition 2.0”:

The section includes various directories, documents and reports intended for accounting of fixed assets:

In order to begin reflecting the fact of receipt, you must use the document of the same name:

Again, different documents are used for assets actually delivered and assets in transit. And when preparing a document for the receipt of fixed assets, intangible assets, legal acts, the fixed asset in which was previously registered in the account of group 107.00 (as a fixed asset in transit), it is better to use the entry mechanism on the basis. Let me explain: if you are expecting some fixed asset that is still on the way, then reflect this fact with the document “Arrival of OS (on the way).” After this fixed asset has arrived, based on the previously entered document “Receipt of fixed assets (in transit)”, we enter the document “Receipt of fixed assets, intangible assets, legal acts”. This is methodologically correct and will simplify your task - most of the details will be filled in automatically.

In our example, we will consider the reflection in the accounting of a fixed asset that has already actually been delivered and the purchase of which will be reflected in the accounts of group 106.00:

Let's use the standard button to create a new document:

The form for filling out the document opens:

Almost any document in the 1C: BGU 8 program consists of a header:

And tabular parts designed as tabs:

Let's fill in the header of the document (the "Agreement" field is not available for editing until the counterparty is selected):

There is also a field in the header - advance credit:

In this field, you can select the option to offset the advance:

By default, it is set to the “Automatic” state - this means that if the advance was paid to the supplier in advance, the program will select it and offset it automatically. When you select this option on the “Advance offset” tab, the form is empty:

The “By document” state means that the user can manually select a document for payment of an advance payment to a supplier, as well as the amount that needs to be credited. When this state is selected, the form also changes:

There is also a hyperlink on VAT in the header of the document, but since VAT deduction is the topic of a separate article, we will not dwell on it in detail.

Let's go back to the first tab. On this tab, information about the capital investment is filled in. In the tabular section, using the “Add” button, fill in the necessary credentials:

Since our example does not include VAT and the fixed asset is purchased new, the columns of the same name are not filled in:

The “Transferred Depreciation” column is filled in if there is already some accumulated depreciation for this fixed asset.

The next three tabs:

These tabs must be filled out if the document documents the receipt of equipment, since the printed form of the equipment receipt act is filled out on the basis of these tabs. In our example, the purchased fixed asset is not equipment, so we will leave them blank.

The last and most important tab of the form is “Accounting Transaction”. This tab determines which transactions will be generated after posting the document. In our example, the typical operation line is empty - this means that more than one operation can be selected in this document:

Until the operation is selected, there are no other details on the form.

Let's look at the operations that can be used in this document:

Operations with clarification (obsolete) do not need to be used; these are old operations that are necessary only for the formation of turnover of past periods (after all, these operations were once used).

The following two operations for gratuitous receipt (receipt without cash costs):

Also included in the list is the operation:

This transaction is used to reflect the purchase transaction of a fixed asset through an accountable entity.

Last operation on the list:

This operation is precisely used when creating a document to reflect the receipt of a fixed asset, previously accounted for as fixed assets in transit.

In our example we use the following operation:

This operation is used when OS is received from suppliers.

When you select an operation, the appearance of the form changes slightly; additional operation details appear that need to be filled out:

I’ll tell you separately about tax accounting. Often, tax accounting in government agencies is simplified or not carried out at all in the program. Therefore, this detail is optional to fill out:

Separately, I note that the program allows you to immediately accept monetary obligations in the document:

Very convenient functionality for generating transactions for accounts in the five hundredth group:

After posting the document, it is necessary to check the resulting transactions. There is a special button on the document form for this purpose:

The first entry concerns monetary obligations: with this document, monetary obligations were accepted for the entire amount of the cost of the fixed asset, since in our example an advance was not paid (remember that monetary obligations are accepted separately before paying the advance):

The second entry is the accrual of capital investments for the entire amount of the cost of the fixed asset:

The third entry concerns tax accounting. Special tax accounts were used to maintain such records:

Once the purchase of a fixed asset has been recorded, all associated expenses can also be collected in the capital account to reflect the true cost. For example, in addition to paying for the cost of the OS, we also paid for delivery.

This fact is reflected in the document:

Create a new document:

Let's fill out the document:

We will select the required standard operation and fill in additional details (accordingly, the operation we need must reflect the fact of investment in the fixed asset), and at the same time we will accept monetary obligations:

After execution, the document generates the following movements on accounts (absolutely similar in composition):

After our manipulations, let’s check the result of the work in the “Turnover Balance Sheet” report:

The result is a debit balance on account 106.31 and a credit balance on account 502.12:

In one of the following articles, we will look at how to take into account a fixed asset, the costs of which are collected in group account 106.00.