World proven oil reserves. World oil reserves. The use of oil in the modern world

Units

In Russia, the amount of oil is usually measured in mass units - tons. In international practice, non-systemic units of volume are used for the same purpose - American oil barrels (1 barrel is equal to approximately 159 liters). This happened because for a very long time international oil production was carried out almost exclusively by companies from the USA and Great Britain, that is, countries in which non-systemic units of measurement are still used very widely. The density of oil varies quite widely - from 0.7 to 1.0 tons per cubic meter. For this reason, there is no one-to-one correspondence between tons and barrels. On average, one ton of oil contains approximately 7-8 barrels. The spread is not so great, because the conversion from tons to barrels and vice versa is usually relevant for more or less large companies that develop quite a lot of fields with oils of varying densities.

Conversion factors between tons and barrels are different for each company. The specific values of these coefficients have a fairly significant impact on the reported volumes of reserves and production of companies and, as a consequence, on their capitalization. Therefore, any reason and any opportunity to set a more favorable value for the conversion factor will certainly be used, in contrast to reasons for revising it in the opposite direction.

World oil reserves and reserve ratio

According to the latest statistical review of world energy from BP, proven global oil reserves amounted to 240 billion tons at the end of 2014. This value includes both traditional and non-traditional reserves. The difference between them mainly lies in the cost of production: for unconventional reserves it is usually an order of magnitude higher due to the need to use extremely expensive technologies. In this regard, unconventional reserves are characterized by a strong dependence of the feasibility of development on the current oil price. For oil companies, these are, in general, second-class reserves; They begin to be developed when traditional reserves in a given oil and gas basin are already severely depleted. Currently, two types of unconventional reserves are being developed on a large scale: heavy oils and oil from low-permeability reservoirs. The latter is also often called shale oil, but this creates confusion with another type of unconventional reserve that is not widely exploited; therefore we will use the first name.

In the same year, 2014, 4.2 billion tons of oil were produced worldwide. Dividing the world's proven reserves by annual production, we obtain an indicator called the reserves ratio; on a global scale it is equal to 57 years. Today's proven oil reserves would suffice for that number of years while maintaining current production levels; however, it is obvious that neither reserves nor production will actually remain at today's levels. Therefore, the absolute value of the reserve ratio should not be taken seriously: the practical significance is mainly the ratio of the oil reserve ratio between regions/countries or in different periods of time.

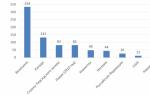

Proven oil reserves in the world are extremely unevenly distributed (see Figure 1). Thus, the oil and gas basin of the Persian Gulf, with a relatively small area, contains 46% of all proven world reserves. The majority (about 96%) here comes from the following countries: Saudi Arabia, Iran, Iraq, Kuwait and the UAE. It should be noted that the next two most important areas (the Orinoco Belt and the Canadian oil sands) contain reserves of unconventional, heavy oil. In addition to these two areas, significant proven unconventional (both heavy and low-permeability) reserves are available in the USA, Russia, China and some other countries. If we consider only traditional, easily accessible oil, the share of the Persian Gulf basin in the world's proven reserves will be about two-thirds. Basically, it is this circumstance that explains the global political significance of this region.

Figure 1. Distribution of proven oil reserves in the world (billion tons).

The Orinoco heavy oil belt, named after the Orinoco River, contains 15% of the world's proven reserves and is located almost entirely in Venezuela. Thanks to this, today Venezuela has the world's largest proven oil reserves. The viscosity of oils from the Orinoco Belt is several orders of magnitude higher than that of traditional oil; Development here requires the use of tertiary development methods, in particular a relatively new thermal method called steam-assisted gravity drainage (SAGD). Horizontal wells are drilled through the oil reservoir in pairs, one several meters higher than the other. Hot steam is pumped into the upper well; the viscosity of the heated oil decreases significantly, and it flows under its own weight into the lower well. The cost of oil production in this way is very high, but without the use of this technology, oil production in this area is, for the most part, completely impossible.

Canadian oil sands contain 11% of the world's proven reserves and are broadly similar to the Orinoco Belt. Until relatively recently, oil was extracted here almost exclusively by open-pit mining. Currently, SAGD technology is being increasingly used. At the same time, out of 27.2 billion tons of reserves, only 4.1 are in active development.

All other regions of the world contain about 28% of proven oil reserves, including in the Russian Federation - about 6%, in Libya, the USA, Nigeria and Kazakhstan - 1.5-2.5% each. All other countries account for about 13%, with each individual country accounting for no more than 1%.

Figure 2 compares the stock ratio between some countries and regions of the world. The undisputed champions here are Venezuela and Canada, due to their huge reserves of heavy oil, most of which are currently not exploited. The reserve ratio is very high in the countries of the Persian Gulf, and the same was in pre-war Libya. In Russia, the reserve ratio is low by world standards - only 26 years. Reserves are exploited even more intensively in the United States.

Figure 2. Multiplicity of proven reserves for some countries and regions of the world (in years).

For traditional oil, the ratio of proven reserves speaks most of all about the possibilities of maintaining or increasing production levels - the higher the ratio of reserves, the less intensively the fields are exploited, and, therefore, the slower the natural decline in production. Therefore, for example, the countries of the Persian Gulf, if necessary, can significantly increase oil production volumes in a short time at low cost, but the Russian Federation cannot handle such a trick. However, in relation to countries with a significant share of unconventional reserves (that is, Venezuela, Canada and the USA), due to the use of specific production technologies, this rule does not always work.

The backbone of the Organization of Petroleum Exporting Countries (OPEC) consists of countries not only with large reserves and large production volumes, but also with a high reserve ratio (Persian Gulf countries, Venezuela, Nigeria, Libya). This circumstance allows them, at least in theory, to regulate the level of production, reducing or increasing it as necessary to influence the oil market. In practice, they succeeded by and large only in the 70s and 80s of the last century.

How reliable are the world's proven reserves?

As mentioned in the previous part of the article, some countries do not disclose detailed geological information about their oil reserves. This primarily applies to many OPEC member countries. At the same time, historically in these countries, oil reserves have repeatedly increased abruptly - some examples are shown in Figure 3. In most cases, no one outside the relevant organizations of these countries knows why this happened. Particularly indicative is the case of Kuwait, whose area is two and a half times smaller than the area of the Moscow region. Oil exploration and production in Kuwait has been carried out since the 1940s; in 40 years, the depths of this small country could be explored far and wide and all available reserves could be calculated. However, in 1984, Kuwait increased its oil reserves by 38%. Other countries of the Persian Gulf, both those shown in the graph and the rest, did not lag behind Kuwait in terms of reserve growth, and even vice versa.

Figure 3. Dynamics of proven oil reserves by individual countries (billions of barrels).

There is no independent confirmation of reserves for such countries; no data on reserves other than those provided directly by the governments of these countries is publicly available. Therefore, many experts today have serious doubts about the reliability of oil reserves in key OPEC member countries.

Reserves in Venezuela increased in 2008-2010 mainly due to heavy oil; in Canada (not shown in the graph), a similar event happened in 1999: oil reserves then increased from 50 to 182 billion barrels. It is important to note that the geological reserves of heavy oil in Venezuela and Canada are many times greater than those proven recoverable and appear to exceed the world's geological reserves of conventional oil. The size of proven recoverable reserves of heavy oil is significantly influenced by the emergence and availability of new technologies (SAGD), as well as the price of oil on the world market. The increase in reserves occurred mainly not due to new discoveries and growth in geological reserves, but due to a reassessment of the profitability of developing these reserves and the predicted oil recovery factor.

Figure 4 shows the dynamics of global proven reserves by group of countries. The graph shows that over the past 35 years, proven oil reserves have generally increased by two and a half times. This happened mainly due to unconventional reserves of heavy oil in Venezuela and Canada, as well as reserves of OPEC countries, about which there are serious doubts. In the rest of the world, inventories increased slightly. At the same time, the time for the discovery of truly large new deposits has irrevocably passed, and the increase in reserves is carried out mainly through revaluation of already known deposits.

Figure 4. World proven oil reserves over time by year (billions of barrels).

However, it often happens that proven reserves have to be revalued downwards. This usually happens in cases where the previous estimate was too high as a result of the desire to certainly increase reserves. For example, in 2004, the large international company Royal Dutch Shell reduced its proven oil reserves by a total of more than 600 million tons, or almost 25%. In 2015, a number of companies involved in the development of unconventional oil in the United States announced a significant (30-50%) reduction in proven reserves due to lower oil prices - the development of a number of areas became deeply unprofitable, and, therefore, the reserves of these areas can no longer be considered proven. Perhaps, for such an excellent reason, geologically absent reserves were also written off.

From the above it is clear that the world's proven oil reserves are likely to be significantly overestimated. Moreover, this applies not only to OPEC member countries, which have political reasons for overestimating reserves. Public (both private and state-owned) oil companies whose shares are traded on stock exchanges regularly conduct international reserve audits. But they also have very good reasons to reflect in their reporting the largest possible amount of proven reserves, since the price of their shares and capitalization greatly depend on this. The credit rating of the organization, in turn, depends on the growth of the latter.

In total, doubtful reserves due to the abrupt increase in proven reserves in different countries amount to up to 40% of the total world volume, or about 100 billion tons.

Probable and undiscovered oil reserves. How long will supplies last?

As already mentioned in the first part of the article, proven oil reserves in a normal situation mean those reserves that exist with a probability of 90% or higher. Of course, with this approach, the most likely value of reserves in known fields is actually higher than proven reserves. To answer the question of how much oil is left in the world, probable reserves must be added to proven reserves, that is, existing reserves with a probability of 50 to 90%.

At the beginning of the development of a field, there are more probable reserves than proven reserves, since the available geological information is not enough to make statements about 90 percent probabilities. The longer exploration and production takes place, the more reserves move from the probable category to the proven category, since as deposits are geologically studied, the uncertainty in reserves becomes less and less. For this reason, it is difficult to assume the existence of a significant amount of probable reserves in known fields in the Persian Gulf oil and gas basin, which has been explored and produced for more than 70 years, especially given the doubts about the reported proven reserves in the area.

Given the fall in oil prices, the profitability of developing even the proven reserves of heavy oils in Venezuela and Canada is in question. So, by and large, it only makes sense to estimate probable reserves using the “rest of the world” category in Figure 4. The order of magnitude for proven and probable reserves is usually about the same, so probable reserves of more than 40 billion tons are unlikely to be expected in known fields.

In addition, there are also undiscovered deposits. An American government organization called the United States Geological Survey in 2012–13 released an assessment of undiscovered conventional and unconventional oil reserves in the United States, as well as conventional oil in the rest of the world, including the Arctic Ocean and Antarctica. In total, the mathematical expectation of undiscovered oil reserves worldwide based on these works is approximately 600 billion barrels, or about 80 billion tons, including about 50 billion tons at sea.

Prospective reserves of unconventional oil are not easy to estimate. Since heavy oil has, for the most part, already been accounted for in the reserves of Venezuela and Canada, it makes sense to talk only about oil from low-permeability reservoirs. In general, in the world today such deposits contain no more than 10 billion tons of proven reserves. Such deposits are located in the same well-studied basins as traditional oil. Therefore, apparently, the order of magnitude of undiscovered reserves in ultra-low-permeability reservoirs is in the first tens of billions of tons.

Thus, in total, the world's probable and undiscovered oil reserves are about half of the proven reserves and do not significantly exceed the doubtful part of these proven reserves. That is, with a moderately skeptical view of the state of affairs, the amount of oil remaining in the world is equal to the amount of proven reserves according to reporting, that is, 240 billion tons. With reasonable (not unbridled) optimism, the amount of remaining oil will be about one and a half times larger, that is, about 360 billion tons. The multiplicity of total oil reserves ranges from 57 to 86 years.

Figure 5 shows that oil consumption in the world has more or less noticeably fallen three times over the past 50 years. In 1973 and 1979, the decline was caused by political events: in the first case, OPEC member countries imposed an oil embargo on countries that supported Israel in the Yom Kippur War, and in the second, the United States imposed sanctions against Iran in connection with the Islamic Revolution that took place there. The third fall occurred in 2008 due to the onset of the current global economic crisis. Otherwise, oil consumption has been growing almost linearly over the past 30 years, despite the growing use of alternative energy sources, the introduction of energy-efficient technologies and other factors negative for oil consumption. Thus, if we do not consider the scenario of a total global economic collapse, there is no reason to assume that the need for oil will begin to decline significantly in the coming years and decades.

Figure 5. World oil consumption by year (millions of tons).

Therefore, from a practical point of view, it is important not when the oil runs out, but when the possibility of increasing or maintaining production disappears, that is, when the so-called “peak production” passes. From calculations and experience it follows that peak production should occur approximately when half of all available reserves have been produced. Due to the uncertainty of proven, probable and undiscovered reserves, it is very difficult to predict exactly when this will happen. In total, from the 19th century to 2014, about 180 billion tons of oil were produced worldwide. Thus, less than half of all oil available on Earth has been produced to date (but at the same time, about 80% of the initially available reserves have already been discovered). Therefore, peak production appears to be a matter of the coming decades.

http://22century.ru/docs/oil-exploration-2

Oil is often called the black gold of modern times. Oil reserves are distributed extremely unevenly across countries. However, absolutely everyone needs this fuel today.

Oil is the No. 1 mineral

The word petroleum, which means oil in many languages, consists of two roots. One of them, "petra" is Latin, and is translated as "stone". The second, “oleum,” is Greek and translates as “oil.” Thus, literally oil is (that is, oil extracted from the earth).

It is known that oil was actively used in Ancient India (in construction), in Babylon (for embalming the bodies of the dead), in Ancient Greece (as fuel). Since the first decades of the twentieth century, it has become the main energy resource on the planet.

So what is oil? It is an oily liquid of natural origin, which consists of a combination of different hydrocarbons. The color of this substance can vary: from rich black to yellowish and even green. The smell of oil is specific and, as a rule, unpleasant, which is explained by its chemical composition.

Oil reserves are distributed very unevenly across countries. Basically, its largest deposits are confined to zones with a thick cover of sedimentary rocks.

The countries with the largest oil reserves (per capita) are Qatar, Kuwait, Turkmenistan, UAE, Saudi Arabia, Venezuela and Libya. By the way, if you recalculate the total oil reserves of Qatar in monetary terms, it turns out that for each citizen of this country there are about 6 billion dollars!

The use of oil in the modern world

Crude oil is practically never used. To obtain technically valuable products (gasoline, solvents, etc.), it must be processed in special plants.

In addition to the fact that oil is very valuable, it is also used for the production of plastics, various plasticizers and additives, dyes, and synthetic rubber.

Oil is a resource that has a number of benefits. Firstly, it has very high energy density. Secondly, oil is quite easily transported over long distances (this is done using pipelines or tankers - huge sea vessels). Thirdly, it can be used to produce a wide range of different products. All these aspects make oil one of the most sought-after commodities on the world market.

However, the reserves of this mineral are rapidly depleting. That is why some countries with significant oil reserves (in particular the United States) began to search (for oil shale, biofuels, and the like).

Features of modern oil production

Until about the mid-70s, oil was produced in the world at a frantic pace. So, if in 1970 about 2 billion tons of this energy resource were extracted from the bowels of the earth, then in 1973 - already 2.8 billion tons. In the early 1980s, global oil production decreased slightly.

Oil production on an industrial scale began in the mid-19th century. During all this time, over forty billion tons of this resource have been “pumped” out of the earth.

Leading countries in the world by oil reserves

Now let’s take a closer look at the geography of distribution of this valuable energy resource.

Oil reserves vary greatly across countries. Thus, some states are completely deprived of this wealth, while others are literally swimming in black gold. The top ten countries by total oil reserves are as follows (see table).

As for oil production volumes, the leaders here are the following countries:

- Saudi Arabia.

- Russia.

- Iran.

- China.

Taking into account two indicators - total oil reserves and annual oil production volumes, you can easily calculate how many years this energy resource will last for each country.

So, the least thing to worry about is Venezuela - it will have enough oil (at today's production rates) for another 235 years. But countries such as Russia, the USA, Canada, Qatar have something to think about. In particular, the United States of America has enough oil reserves for only 11 years, Russia for 22 years, Canada for 26, Qatar for 45.

Oil prices: expert forecasts

As of today, the price of one barrel of Brent is fixed at $64, WTI - $61.

Oil prices (like any other commodity on the world market) are determined based on the relationship between supply and demand for it. Today, supply for this energy resource still exceeds demand. In addition, pricing in this case is also influenced by other factors (let’s call them political). We are talking about military conflicts in Libya and Yemen, as well as the deployment of US shale projects.

Many economic experts predict that in the next two months oil prices will rise to $70, but after that the price of this resource will begin to fall again.

In the third quarter of 2015, as analysts predict, the price of oil may find its new bottom, reaching $50 per barrel.

Finally...

Oil is the most important energy resource of our time. The leading countries in terms of oil reserves (total) are Venezuela, Saudi Arabia, Canada, Iran, Iraq, and Mexico. However, scientists warn: at the current rate of oil production, this resource in most countries of the world will only last for 40-80 years. That is why some states have already begun to think about alternative energy sources.

Gasoline fuel, which is created as a result of oil refining, continues to occupy a dominant position, despite active attempts to use alternative energy sources.

Gasoline is the main product of oil refining. Understanding the strategic importance of hydrocarbons for economic development, experts regularly monitor oil reserves in the world.

World oil reserves

Currently, the assessment of the amount of oil is determined in accordance with the technical capabilities of its production.

There are several classifications for assessing oil reserves. The most common is the SPE-PRMS classification, which allows you to determine not only the condition of the deposits, but also makes it possible to calculate the efficiency of its extraction.

If the presence of oil in a field is confirmed, then the probability of its production is 90%, if “probable” - 50%, and with reserves defined as “possible” - only 10%.

In 1997, the UN proposed its classification of resource assessment - UNFC-2009, which is based on the following criteria:

- economic and social viability of the project;

- status and validity of the field development project;

- geological exploration.

In Russia, there is a classification according to which oil and gas reserves are divided into categories based on the knowledge of the degree of industrial development. It is important to emphasize that global oil reserves are constantly changing due to the discovery of new fields and the depletion of existing fields. As of the beginning of 2017, total world oil reserves amounted to 1,706.8 billion barrels.

Shale oil reserves in the world

In recent years, shale oil has been actively entering the market around the world. Total volumes of oil shale are about 345 billion barrels. But the development of shale oil is economically feasible only where the formation thickness does not exceed 30 meters and the oil content is 90 liters per ton of shale.

The greatest concentration of territories suitable for shale oil production is observed in the United States, which is actively promoting the idea of a “shale revolution,” but in terms of total reserves, Russia ranks first.

The development of shale deposits creates serious problems for the ecology of the production area, which is a limiting factor for development. The decline in traditional oil reserves and the development of technology suggest that this area has great prospects.

Oil reserves by country of the world

According to the BP Statistical Review of World Energy, in 2016, the ten main oil-producing countries extracted more than 3 billion tons of oil from the ground. Our country is in the top ten - Russia accounted for 554.3 million tons or 12.6% of global production, and Saudi Arabia became the main producer with 585.7 million tons, which in share terms amounted to 13.4%.

The US figures were 543 million tons, including shale oil, and in shares - 12.4%. According to this source, the ranking of countries in terms of proven oil reserves does not coincide with the indicators of its production volumes. The largest resources - 17.6% or 300.9 billion barrels, including heavy oil from the Orinoco belt, are concentrated in Venezuela. Next, with 266.5 billion barrels (15.6%) follows Saudi Arabia, Canada with 171.5 billion (10%), Iran - 158.4 billion (9.3%), Iraq - 153 billion. (9%), Russia – 109.5 billion (6.4%), Kuwait – 101.5 billion (5.9%), UAE – 97.8 (5.7%).

The rest of the countries, including the USA and Libya, have 347.7 billion barrels of oil (20.5%).

Venezuela oil reserves

As noted above, Venezuela has the largest oil reserves, about 300.9 billion barrels. But due to the fact that Venezuela placed its main emphasis on the export of hydrocarbons, in the context of a global drop in oil prices, the country found itself in a deep economic crisis.

Extraction is carried out from deposits in the basins:

- Maracaibo;

- Apure;

- Falcon;

- Orienta.

Production is also carried out in the Orinoco belt, where oil classified as heavy and super-heavy is concentrated, which makes its production unprofitable given the current economic climate.

Proven oil reserves in Russia

According to the Ministry of Natural Resources of the Russian Federation, the increase in liquid hydrocarbon reserves in Russia in 2016 amounted to 575 million tons and further growth is predicted due to the discovery of new oil territories. Russia's total proven reserves amount to over 14 billion tons.

For their effective development, it is imperative to use the latest achievements of science and technology, which can significantly reduce costs. This is due to the fact that the country also has significant reserves of hard-to-recover oil (over 60% of the total number of fields in Russia).

Oil companies from all over the world at the exhibition

Of great importance for companies associated with the oil business is the opportunity to get acquainted with the latest trends in the development of the industry, express themselves and present their products. To this end, leading oil-producing countries hold specialized exhibitions, which to a certain extent become a platform for solving these problems.

In Moscow, with the support of the Ministry of Energy of the Russian Federation, the Expocentre Fairgrounds has been holding an international exhibition of equipment and technologies for the oil and gas complex for several years now. "Neftegaz".

At the exhibition, leading enterprises from around the world present samples of special equipment, innovative developments, and scientific and technical achievements.

In addition, an important part of the exhibition is the National Oil and Gas Forum, within which the most significant and controversial issues existing in the industry will be discussed.

Global proven oil reserves (as of 2015) amount to 1657.4 billion barrels. The largest oil reserves - 18.0% of all world reserves - are located in Venezuela. Proven oil reserves in this country amount to 298.4 billion barrels. Saudi Arabia is the second largest country in the world with oil reserves. The volume of its proven reserves is about 268.3 billion barrels of oil (16.2% of the world's total). Proven oil reserves in Russia account for approximately 4.8% of the world's reserves - about 80.0 billion barrels, in the USA - 36.52 billion barrels (2.2% of the world's total).

Oil reserves in countries of the world (as of 2015), barrels

Oil production and consumption by country

The world leader in oil production is Russia - 10.11 million barrels per day, Saudi Arabia is in second place - 9.735 million barrels per day. The world leader in oil consumption is the United States - 19.0 million barrels per day, China is in second place - 10.12 million barrels per day.

Oil production by country (as of 2015), barrels/day

data http://www.globalfirepower.com/

Oil consumption by countries of the world (as of 2015), barrels/day

data http://www.globalfirepower.com/

Experts from the International Energy Agency (IEA) expect global oil demand to increase by 1.4 million barrels per day in 2016 to 96.1 million barrels per day. In 2017, global demand is forecast to reach 97.4 million barrels per day.

World oil exports and imports

The leaders in oil imports are currently the United States - 7.4 million barrels per day and China - about 6.7 million barrels per day. The leaders in exports are Saudi Arabia - 7.2 million barrels per day and Russia - 4.9 million barrels per day.

Export volume by country in 2015

| place | a country | export volume, barrels/day | change,% compared to 2014 |

| 1 | Saudi Arabia | 7163,3 | 1,1 |

| 2 | Russia | 4897,5 | 9,1 |

| 3 | Iraq | 3004,9 | 19,5 |

| 4 | UAE | 2441,5 | -2,2 |

| 5 | Canada | 2296,7 | 0,9 |

| 6 | Nigeria | 2114,0 | -0,3 |

| 7 | Venezuela | 1974,0 | 0,5 |

| 8 | Kuwait | 1963,8 | -1,6 |

| 9 | Angola | 1710,9 | 6,4 |

| 10 | Mexico | 1247,1 | 2,2 |

| 11 | Norway | 1234,7 | 2,6 |

| 12 | Iran | 1081,1 | -2,5 |

| 13 | Oman | 788,0 | -2,0 |

| 14 | Colombia | 736,1 | 2,0 |

| 15 | Algeria | 642,2 | 3,1 |

| 16 | Great Britain | 594,7 | 4,2 |

| 17 | USA | 458,0 | 30,5 |

| 18 | Ecuador | 432,9 | 2,5 |

| 19 | Malaysia | 365,5 | 31,3 |

| 20 | Indonesia | 315,1 | 23,1 |

OPEC data

Import volume by country in 2015

| place | a country | import volume, barrels/day | change, % compared to 2014 |

| 1 | USA | 7351,0 | 0,1 |

| 2 | China | 6730,9 | 9,0 |

| 3 | India | 3935,5 | 3,8 |

| 4 | Japan | 3375,3 | -2,0 |

| 5 | South Korea | 2781,1 | 12,3 |

| 6 | Germany | 1846,5 | 2,2 |

| 7 | Spain | 1306,0 | 9,6 |

| 8 | Italy | 1261,6 | 16,2 |

| 9 | Fraction | 1145,8 | 6,4 |

| 10 | Netherlands | 1056,5 | 10,4 |

| 11 | Thailand | 874,0 | 8,5 |

| 12 | Great Britain | 856,2 | -8,9 |

| 13 | Singapore | 804,8 | 2,6 |

| 14 | Belgium | 647,9 | -0,3 |

| 15 | Canada | 578,3 | 2,6 |

| 16 | Türkiye | 505,9 | 43,3 |

| 17 | Greece | 445,7 | 6,0 |

| 18 | Sweden | 406,2 | 7,5 |

| 19 | Indonesia | 374,4 | -2,3 |

| 20 | Australia | 317,6 | -28,0 |

OPEC data

How many years will oil reserves last?

Oil is a non-renewable resource. Proven oil reserves (as of 2015) are approximately 224 billion tons (1657.4 billion barrels), estimated - 40-200 billion tons (300-1500 billion barrels).

By the beginning of 1973, the world's proven oil reserves were estimated at 77 billion tons (570 billion barrels). Thus, proven reserves have been growing in the past (oil consumption is also growing - over the past 40 years it has grown from 20.0 to 32.4 billion barrels per year). However, since 1984, the annual volume of world oil production has exceeded the volume of explored oil reserves.

World oil production in 2015 was about 4.4 billion tons per year, or 32.7 billion barrels per year. Thus, at the current rate of consumption, proven oil reserves will last for about 50 years, and estimated reserves will last for another 10-50 years.

US oil market

As of 2015, the United States imported approximately 39% of its total oil consumption and produced 61% independently. The main countries exporting oil to the US are Saudi Arabia, Venezuela, Mexico, Nigeria, Iraq, Norway, Angola and the UK. Approximately 30% of oil imported into the United States and 15% of total oil consumption in the United States is oil of Arab origin.

According to experts, strategic oil reserves in the United States currently amount to more than 695 million barrels, and commercial oil reserves are about 520 million barrels. For comparison, Japan's strategic oil reserves are about 300 million barrels, and Germany's are about 200 million barrels.

US oil production from unconventional sources increased approximately fivefold between 2008 and 2012, reaching almost 2.0 million barrels per day by the end of 2012. By the beginning of 2016, the 7 largest shale oil basins were already producing about 5.0 million barrels daily. The average share of shale oil, or light tight oil as it is often called, in total oil production in 2016 was 36% (compared to 16% in 2012).

Conventional crude oil production in the United States (including condensate) amounted to 8.6 million barrels per day in 2015, which is 1.0 million barrels per day less than in 2012. The total volume of oil production in the United States, including shale, in 2015 amounted to more than 13.5 million barrels per day. Much of the increase in recent years has been driven by increased oil production in North Dakota, Texas and New Mexico, where hydraulic fracturing (fracking) and horizontal drilling technologies have been used to produce oil from shale formations.

In percentage terms (up 16.2% from the previous year), 2014 was the best year in more than six decades. Annual increases in oil production regularly exceeded 15% in the first half of the 20th century, but these changes were smaller in absolute terms because production levels were significantly lower than they are now. US oil production rose in each of the previous six years. This trend followed the period from 1985 to 2008, in which oil production fell in every year (except for one year). US oil production growth stalled in 2015 due to a sharp drop in oil prices in the second half of 2014.

According to the latest IEA estimates, conventional oil production in the United States in 2016 will be 8.61 million barrels per day, in 2017 - 8.2 million barrels per day. US oil demand in 2016 will average 19.6 million barrels per day. The average oil price forecast for 2016 was raised to $43.57 per barrel, for 2017 - to $52.15 per barrel.

World statistics cannot confidently answer the question “how much oil is there in the world.” Therefore, research results and expert opinion are always called into question. This is due to the fact that currently only 25 percent of the world's oil fields are being developed.

Research results show that the world reserve is significantly reduced; analytical examinations prove that the reserve is approximately 1,700 billion barrels. This share will provide humanity for only forty years.

The statistics presented in the article are current as of the end of 2016. The ranking of countries producing the largest amounts of black energy has remained virtually unchanged over the past ten years.

Three leaders controlling the largest reserves

Oil fields are often the cause of many conflict situations between countries. For example, African countries are arguing over oil-rich territory, Libya has conflicting interests with Nigeria, Cameroon with Chad, and there are more than twenty similar disputes.

Latin American states have more than eight conflicts over oil fields, and there are also controversial issues in Europe and the Middle East.

- Venezuela– produces just over three percent of the world. Experts estimate that oil in Venezuela will run out no sooner than in 120 years. The country's oil potential is more than 290 billion barrels or 17% of world reserves. However, the oil of the Latin country has its own characteristics - it is heavier and more difficult to extract. The country ranks tenth in the world in oil production.

- Saudi Arabia- the main extractor and producer of the world's oil potential. Oil reserves amount to more than 265 billion barrels(more than 15% of the world). According to experts, the oil fields in the state will currently provide the country with fuel for more than eighty years. Arabia is the largest producer and supplier of black gold.

- Canada– the share of oil reserves in the country is over 173 billion barrels(more than 10%) mainly due to hard-to-recover oil from sands. The profitability of producing such oil is approaching $90 per barrel. Canadian companies are the main suppliers of oil to America.

The potential of “black gold” in other countries

Most states spend very impressive sums, tens of billions of dollars annually, on the development of oil fields.

- Iran– produces about 4% of the world's oil resources. However, according to researchers, Iran's black gold reserves may run out in seventy years. Iran's share is more than 150 billion barrels (about 9%). Production in the country has been growing since sanctions were lifted and could grow even more in the coming years.

- Iraq. Iraq's largest field, Rumaila, accounts for the majority of the country's production. Iraq's reserves account for about 150 billion barrels, more than 8% of the world's total.

- Russian Federation– produces about 12.5% of oil, having 6% of the world's proven reserves. Experts' forecasts for the availability of oil are disappointing; Russian oil from present deposits may run out within twenty-five years. One of the reasons for this period is considered to be unreasonable government policy. Despite this, the Russian share is 89 billion barrels. However, it is worth considering that Russia still has a lot of hidden reserves - in the Arctic (according to experts, about 90 billion barrels), as well as in shale formations (about 75 billion barrels of recoverable reserves). Developing tight oil reserves requires large investments and high oil prices. The state's economy is mainly built on the export of produced gas and oil.

- Kuwait- about 6% of the world's deposits. Just like in the UAE, oil production can last for about a hundred years. Kuwait's potential is 101 billion barrels.

- United Arab Emirates– the share of the world is comparable to Kuwait - about 6%. Research shows that oil production in Arab fields can last for more than a hundred years. The country holds about 97 billion barrels. Despite the growth of global tourism in this country, much of the economy is supported by energy production and resource extraction.

- USA– produce about 12% of oil, but own only 3%. Moreover, America's oil reserves may run out in the next ten years. The share of oil potential is 34 billion barrels of traditional oil and another about 60 billion of shale oil. America is the second country in the world in terms of consumption of natural energy resources. Moreover, its consumption accounts for more than twenty-five percent of the global level. Due to the introduction of new technologies, the country is increasing shale oil production.

Percentage distribution of world reserves confirmed by analysts and researchers in this field. The remaining countries involved in oil development and supply account for about twelve percent of the world's reserves.

The world's total reserves are approximately 1.7 trillion barrels However, actual reserves may be much larger, due to still unexplored deposits - mainly shale oil, as well as on the shelf.

Countries with relatively small oil reserves

- Libya– the share of oil potential is 3%, although forecasts state that oil production in Libyan fields can be carried out for about sixty years. Proven oil reserves are 47 billion barrels. Libya is in 4th position in gas and oil development on the African continent. The country's economy is based on oil production and exports, which accounts for more than ninety percent of the treasury.

- Nigeria– the country’s share of oil is just over two percent. Nigeria's current oil reserves will run out in 35 years. The potential is about 37 billion barrels. The country is very dependent on the export of black gold - about 80-90% of all budget revenues. The state has the largest deposits on the African continent.

- Kazakhstan– the amount of oil reserves is thirty billion barrels(1.8% of world reserves). After gaining independence, Kazakhstan began to attract global investors. At the same time, the flow of foreign investment into the state’s oil industry has increased significantly.

- Qatar. Natural raw materials in Qatar are extracted from large deposits. The oil industry's potential is more than 25 billion barrels. Reliability in the oil industry ensures the prosperity of the state. Qatar is in fourth place among countries in the ranking for supplies of dry blue fuel.

- China– produces more than 200 million tons at its fields. oil per year. Market share - 5%. Residual reserves in the depths of China 18.5 billion barrels(about 1% of the world). The most populous country has the fastest growing economy. China is the world's leading energy consumer. Every year companies increase the production of natural fuels, but still the main source of energy for China is coal.

- Algeria– the share of global potential is 0,7% (just over twelve billion barrels). A major producer and extractor, Algeria is in second position among African oil production states. The state parliament attracts investment by reducing taxes for developers of the gas industry and fields.

- India– the share of oil potential is five and a half billion barrels. Fourth place in consumption and import of natural fuel. At the moment, the state is not able to satisfy the need for energy resources within the country. The country's priority has been to increase fuel reserves.

- Australia– 3.8 billion barrels. The continental country attracts global mining companies with its political stability and proximity to Asian countries. The influx of cash from foreign companies has a positive effect on field development. The continent is rich in uranium reserves.

Geographical distribution of oil industry reserves

According to statistics over the past ten years, the Middle and Near East have seen the largest increase. In these areas, oil reserves have increased by one and a half times.

Canada and the South of North America are in second place in the development of oil fields.

Educational information

The absurdity of the situation in the Russian Federation still dismays some analysts. The country with the highest oil production has an inflated cost of gasoline and diesel fuel. However, if we take oil production per capita, Russia is far from the leading position.

In countries whose main budget depends on the oil industry, for example, the United Arab Emirates, the price of gasoline does not exceed six rubles, but per capita oil in such countries is much more than in Russia. It turns out that 60 percent of the price for gasoline consists of various fees, excises and taxes.