Accrual of bl. Payroll calculation during sick leave. How to find out the insurance period for sick leave

To calculate sick leave, you should know the following values:

- insurance period - what it is and how it is calculated, read;

- salary for the last 2 calendar years;

- the number of calendar days worked in this period;

- number of sick days to be paid.

Calculate the amount of sick leave benefits using the online calculator -.

Calculation of sick leave

The formula for calculation takes the following form:

Sickness benefit = average daily earnings. * % depending on the insurance period * number of days of sick leave.

- determine the average daily earnings for the billing period,

- calculate the amount of insurance experience,

- establish what percentage of payment corresponds to this length of service;

- calculate how many days of sick leave need to be paid;

- multiply the required values.

Average daily earnings

To calculate it, you need to establish which period should be taken as the calculation period. According to the law, this is 2 years, and calendar years, that is, from January 1 to December 31. The years should be those that come before the year of incapacity.

If the employee was on maternity leave during these years or was caring for a child under 3 years old, then one or two years can be replaced by earlier ones, preceding the maternity leave. Such a replacement needs to be made only in the case where such a replacement will cause an increase in benefits.

Average earnings per day should be calculated for a certain pay period.

Formula for calculating average daily earnings for sick leave:

Average daily earnings = salary for calculated per. / number of days in calculated per.

That is, you should add up all payments made to the employee over 2 years. If the employee did not work in this place of work during these years, then you need to obtain certificates from previous places. It is better to take care of such a certificate in advance and receive it upon dismissal. Income certificates will allow the current employer to take into account all payments made to the employee in the accounting years.

The law provides for an income limit; payments above the limit are not included in the calculation. In 2014, the limit was 624,000 rubles, in 2015 - 670,000 rubles, in 2016 - 718,000 rubles. When calculating benefits in 2016, the maximum possible income that can be taken into account in the calculation is 624,000 + 670,000 = 1,294,000 rubles.

If the total income for 2 years is less than 24*minimum wage for the year of calculation, then the calculation must be carried out according to the minimum wage, when the minimum wage * 24 months is taken as the total income for the calculation period. In 2016, the minimum wage = 6204 rubles, which means the minimum possible income for 2 years = 6204 * 24 = 148896 rubles. From July 1, it is planned to increase the minimum wage to 7,500 rubles.

The number of days for 2 years - the number of calendar days is summed up; for 2014 and 2015 it is 730 days. From these days, you should deduct sick days, unpaid leave for more than 14 days, days of maternity leave and days of parental leave. Payments made during these periods are not included in the calculation of sick leave benefits.

Knowing the total number of calendar days in the billing period and the total income for this period, you can determine the average daily earnings by dividing the income by days.

Insurance experience

These are periods of employee work with deduction of insurance contributions to the Social Insurance Fund. This takes into account not only the time worked under an employment contract, but also service in various bodies, including the army, municipal and state service.

Full years (from January 1 to December 31), full months (from the first to the last) and days of the specified periods are summed up. Next, the days are converted to full months, taking into account the fact that one full month is 30 days. Months are converted to full years, taking into account the fact that 12 months. - that's one full year.

The result should be the insurance period expressed in full years and full months.

% of sick pay from insurance period

The length of service depends on what percentage will be paid to the employee on sick leave:

- experience< 5л. — 60%;

- experience > 5 years, but< 8л. — 80%;

- experience > 8 years. - 100%.

If the sick leave is issued for the employee himself, then all days of the sick leave certificate for loss of ability to work are calculated taking into account the specified dependence.

If another close relative and sick leave is open due to the need to care for him, then only the first 10 days of sick leave are paid for the specified dependence; 50% of the payment is applied to the remaining days.

Number of sick days

If an employee falls ill, all days of sick leave must be paid, including holidays and weekends.

If a child or another family member is sick, there are some restrictions.

If the employee is on vacation

If an employee falls ill during his main leave, it is extended for sick days; if an employee falls ill during other types of leave, they are not extended.

If a child falls ill, then regardless of what type of leave the employee is on, sick leave is not paid.

Calculation example

An employee fell ill, calculation data:

- insurance experience - 7 years. 5 m.;

- sick leave - from 05/12/2016 to 05/20/2016;

- from 05/10/2016 to 05/15/2016 the employee was on leave without pay;

- in 2015, the employee was on sick leave for 10 days;

- earnings in 2014 — 600,000 rub.;

- earnings in 2015 — 700,000 rub.

If a company employee goes on sick leave, then the accounting department naturally faces the question of how it will need to be paid. Of course, for experienced specialists who follow all changes in legislation, this is not a problem. But for young accountants, it is important to find out all the nuances in order to know what to pay attention to when taking out sick leave. How compensation is calculated for the period of incapacity for work - this also needs to be clarified in advance.

Who is entitled to receive sick leave?

Every officially employed employee has the right to social guarantees in case of temporary loss of ability to work. This is promised by Article 39 of the Russian Constitution. The Social Insurance Fund handles financial compensation for sick leave. Moreover, it is this organization that checks the correctness of the calculation of assistance amounts, monitors the implementation of legislative acts by organizations and works in the interests of the final recipients of social guarantees.

In order to receive the payment required by law, the employee is required to provide the employer with sick leave. It is this document that confirms the fact of the disease. All necessary accruals and calculations are carried out by the employer’s accounting department, and the fund only deals with the payment of the declared amounts and their verification. By the way, every organization that employs employees is required to register as an insurer.

Rules for filling out sick leave sheets

In order for the Social Insurance Fund to pay for sick leave, there must be no errors in it. Clinic staff are in charge of filling out these documents, but it is advisable for the sick person to independently check the accuracy of the data on the certificate of incapacity issued to him. If errors are found, he will be provided with a duplicate, because blots and corrections in this document are unacceptable. The accountant responsible for calculating employee benefits should also check the correctness of completion.

The most common errors are in the patient’s name and date of birth. Also, health workers often make mistakes when filling out the start and end numbers of sick leave. If a patient has 2 or more sick leave certificates in a row, then only one number can match. For example, in one clinic a person closed his sick leave, and in another he opened it on the same day. In certain cases, the position of a doctor is also important. Sick leave issued in connection with pregnancy and childbirth is issued only by an obstetrician-gynecologist. If this document indicates another position, it must be replaced.

But inaccuracies in the name of the organization should not cause concern. The FSS determines the policyholder based on his individual number, which is indicated by the company itself.

Who pays sick leave

Just a couple of years ago, all sick leave was paid directly by the employer. Only after this did he report on the funds spent to the Social Insurance Fund, which compensated his expenses. At the same time, he did not return the funds to the company or individual employer, but counted them against future contributions to the Social Insurance Fund.

This order has now been changed. The employer no longer pays for the provided certificate of incapacity for work; he is only obliged to carry out all the necessary calculations. And the transfer of funds due to the employee is already handled by the FSS.

Calculation of average earnings

It must be remembered that from January 1, 2012, the procedure for determining this amount has changed significantly. Thus, currently the base calculation period is not 12, but 24 calendar months, or 730 days. After a company employee recovers, he must bring sick leave. It is not at all necessary for the employee to know how the payment due to him is calculated. From this moment the work of the accounting department begins. First of all, in order to determine how much social benefits an employee is entitled to, it is necessary to calculate his average daily earnings.

The calculation of the average for sick leave is determined as follows. The employee’s entire accrued income for the last two years is divided into 730 days. At the same time, the amount includes absolutely all payments, bonuses, rewards for which contributions to the Social Insurance Fund were accrued.

How are the required sick leave amounts determined?

In addition to the fact that the accounting department must correctly determine the employee’s average daily earnings, it must also remember what percentage of the established amount is supposed to be paid for sick leave. The amount of social guarantees depends directly on the employee’s length of service.

For persons who have insurance experience:

- did not exceed 5 years, 60% of the income received is paid;

- is from 5 to 8 years - 80%;

- over 8 years - 100%.

It is important to remember that it is not the continuous, but the total time the employee worked at all places of employment where contributions to the Social Insurance Fund were made that are taken into account.

Calculation for previously unemployed persons

One of the most common problems accountants face is calculating benefit amounts for employees who have been with the organization for less than two years. To calculate the required disability compensation, the accounting department will need a certificate from the last place of work for two calendar years. If the employee does not provide it, then the calculation is based on the minimum salary for the period when he was not registered with the employment service. You should also know that they are not taken into account when determining the amount of average daily earnings.

The amount of disability compensation is determined based on the minimum wage if one of the following conditions is met:

- the employee has no insurance accruals for the last 24 months;

- The employee's insurance period is less than 6 months;

- monthly earnings are less than the established minimum wage.

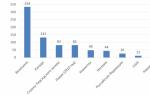

Changes in the amount of payments

When receiving sick leave from an employee, the accounting department must not only know how to correctly carry out all calculations of social compensation due for payment, but also remember that their amount per month cannot exceed the established limit. In 2013, the maximum amount was 58,970, in 2014 - 61,920, in 2015 it will be 65,020 rubles.

It is clear that the levels of these payments can only affect the highest paid employees who already have a fairly long insurance period. Most companies that set average wages will not be affected by these maximum contribution amounts.

The changes will also affect the following categories of employees:

- who was injured in the workplace through their own fault, violated labor discipline, or was intoxicated (it does not matter whether it was drugs or alcohol);

- who did not undergo a medical examination in a timely manner without a good reason;

- who did not comply with the established hospital regime.

In this case, the accountant must know how to correctly calculate such sick leave and how it is calculated. Indeed, for established cases, the calculation is made based on

Calculation features

Starting from 2013, the basis for calculating due payments is the last two calendar years. In most cases, the period that precedes the insured event is taken. However, there are situations when an employee has the right to choose the period that will be the basis for calculations. Thus, this opportunity is provided to those who have been on leave in one or both of the last years, which was granted in connection with pregnancy and childbirth or to care for a baby.

If an employee has one of the described cases, then you should not be afraid to take sick leave. Any accountant must know how compensation is calculated in this case. The period can be selected:

- 30 calendar days;

- 731 or 732 calendar days if the employee chose one or two leap years as the calculation base.

True, such a replacement is possible only at the request of the employee and subject to the condition that this will lead to an increase in compensation payments.

Calculation of benefits during pregnancy and childbirth

If sick leave is provided by the expectant mother, then the employer calculates the amount of insurance payments due to her. As in other situations, the basis for this is two calendar years. In this case, the person involved in the accruals must take into account what the maximum base for accrual of insurance premiums was in each period.

The calculation and payment procedure for this benefit have their own characteristics. When determining the amount of average daily earnings, the total amount of income received is divided by 730 calendar days. And when calculating the amount of benefits paid in connection with the upcoming birth, the following are removed from the period:

- days of temporary disability;

- the time during which the employee was released from work with the preservation of her wages, if she was not accrued at the specified time;

- leave for pregnancy, childbirth or child care.

If a woman voluntarily entered into the compulsory social insurance program, then in this case the average daily earnings are determined based on the minimum wage established on the day the insured event occurred. It is simply divided by the number of days in each month on which sick leave falls.

Work injuries

If an employee was injured at work, then this case will have its own peculiarities in calculating the required insurance payments. So, if the injury did not occur due to violation of labor discipline by the employee himself, then the benefit will be paid in the amount of 100% of earnings.

True, it is important to take into account all the norms of Law No. 36-FZ, adopted on April 5, 2013. It is this document that establishes the maximum amounts of possible insurance payments in case of temporary disability of an employee that occurs in connection with an accident that occurred at the enterprise. For a full calendar month, they cannot exceed four times the maximum monthly amount.

For example, in 2014, an injured employee can be paid no more than 247,680 rubles (61,920 x 4 months).

A sick citizen goes to a clinic, where he is given a certificate of incapacity for work, paid according to certain rules, for the entire duration of his illness. The procedure for calculating the amount of sick leave is constantly changing. How payment is made, what indicators influence the amount of payments - questions of interest to anyone who is sick.

The legislative basis for registration and payment of temporary disability benefits is. Payments are accrued to all employees of the enterprise ( Article 183 of the Labor Code of the Russian Federation), including part-time workers.

A certain limit has been established when paying for days when the employee could not be at work due to his illness or the illness of a relative (child). According to Article 5 of Federal Law No. 255 Paid stay at the bulletins during:

- illnesses, injuries: benefits are accrued for the entire period the doctor declared the person incapable of work;

- caring for a sick relative: payments are made no more than 7 days for each case and should not exceed 30 days per year;

- caring for a sick child under 7 years of age and from 7 to 15 years of age: sick leave is paid for a period not exceeding 60 and 45 days per year, respectively;

- care for a disabled child: the state pays for 120 days a year;

- recovery after surgery: 12 months provided;

- undergoing sanatorium-resort treatment: no more than 24 paid days are provided;

- maternity leave: payments are made for 140 days.

Important! Sick leave is paid even in a situation where a person quits his job and immediately falls ill within a month. The employer is obliged to pay 60% of average earnings ().

Exceptional situations when payment for days of incapacity to work is not made to an employee include:

- being on leave without pay;

- detention;

- idle time;

- suicide attempt;

- receiving a domestic injury within the first five days .

How are sick leave paid?

Payment for sick leave is carried out at the expense of:

- enterprise reserves;

- amounts of the Social Insurance Fund (SIF).

If the employee himself falls ill, the first 3 days are paid for by the company, all subsequent days are paid for by the Social Insurance Fund. When drawing up a document for care, all due days are paid in full from the Social Insurance Fund.

Important! Payment for incapacity for work is made for the calendar days specified in the sick leave.

Registration of a hospital document

A sick leave certificate is an official document indicating a valid reason for absence from work. The document is drawn up on a special form that has certain degrees of protection.

Important! If an employee is registered in several organizations, then a document on temporary disability is issued for each of them. A mark is placed on it: this is the main place of work or part-time.

From 01/07/2017, electronic sick leave certificates are being introduced as an alternative to paper documents. The patient's consent is required before it is provided.

Illness while on vacation

If a citizen falls ill while on regular vacation, then Article 124 of the Labor Code of the Russian Federation he has a choice:

- Transfer vacation days that coincided with illness to another period. (In this case, you must write a statement indicating the transfer dates.)

- Continue to take your allotted vacation. There is no need to fill out any paperwork, the vacation is extended automatically.

Important! Extension due to illness applies only to main and additional leave. If a child falls ill during an employee’s vacation, the issued bulletin will not affect the duration of the vacation in any way.

In 2018, no major changes were adopted when paying for a document recording temporary disability. The size of the benefit is influenced by 2 main indicators:

- work experience;

- amount of earnings.

Experience is the main component in determining payments for illness.

| Experience for sick pay | Payment amount |

|---|---|

| Over 8 years | 100% |

| From 5 to 8 years | 80% |

| From six months to 5 years | 60% |

| Less than six months | from the minimum wage |

How sick leave is calculated: basic rules and formula for calculating sick leave + 6 examples of calculating benefits for employee disability + formula for calculating sick leave in connection with pregnancy and childbirth for women.

According to statistics, people spend most of their time at work. During the course of their lives, they naturally get sick or injured. If this happens during the period of official employment, then employees are entitled to sick pay.

Sick leave is a type of material support for the working population during a period of deterioration in the health of oneself or those of loved ones, children. They are also awarded to working women in a position who are preparing for the upcoming childbirth and motherhood.

To calculate the amount of financial assistance, a formula is used, which, unfortunately, is not clear to everyone. To analyze the method and future size of payments depending on various factors, we will tell you how sick leave is calculated and what its size will be in each situation.

How sick leave is calculated according to general rules: basic formula

The Labor Code of the Russian Federation states that every working citizen of Russia has the right to apply for temporary disability and receive compensation for it.

Who is eligible for financial assistance? All citizens who are officially employed and who make contributions to the FSS - Social Insurance Fund.

Everyone has the right to sick leave: both those who work overtime and those who work only a few hours a day. The only difference is the amount of benefits received.

What can compensation be calculated for? For injuries, illnesses, not only your own, but also your family’s. You can receive financial compensation if you catch a cold on a rainy day, and if your relative needs care due to a serious illness.

The number of days for which you can take sick leave and receive financial assistance depends on the complexity of the situation.

If the matter concerns the employee himself, then he has the right to take out paid sick leave for:

- 30 calendar days per year is the maximum allowable number of sick days that applies to all sick employees.

- 90 calendar days – in cases where the illness has been prolonged, and this can be confirmed by a medical commission.

- 120 calendar days - when the employee is very sick, and the commission speaks about the possibility or need to open a disability.

If we are talking about a certificate of incapacity for work, which is issued due to the illness of one of the family members (most often children), then temporary incapacity for work can be issued for 60 calendar days of illness per year. But in a number of situations this period can be increased or decreased.

Such situations include the following:

- The child whose illness prevents the employee from coming to work is less than 7 years old. Then forced vacations can reach up to 90 days a year.

- The age of the child or children ranges from 7 years to 15. This reason reduces the maximum permissible number of days of incapacity to 45.

- The child is disabled regardless of the group. In such cases, sick leave is entitled to up to 120 days of illness per year.

In addition to cases of exceptions, there are also situations when sick leave is not paid at all. These include circumstances such as remission of a chronic disease or treatment of a citizen over 15 years of age in a hospital.

Now let’s move directly to the question of how sick leave is calculated in Russia according to legal norms.

So, for every working person, a fairly simple formula is used:

At first glance, everything looks quite simple, but, as a rule, when starting to calculate the amount of compensation, questions often arise. This is not surprising, because in order to calculate the amount, you need to understand what data to substitute into the formula.

Let's look at them in more detail:

SDZ or average daily earnings.

This value represents the “arithmetic average” earnings of each employee for one day. How is this value calculated?

To obtain it, you need to analyze the income for the last two years of work (they are called the billing period), and divide them by the number of days in two years. The last value is unchanged and is always 730.

Each year the maximum amount of earnings is limited. If we sum up these maximum values and divide them by 730, we get the maximum average daily income.

It’s good if your earnings are close to these figures, and you can calculate your average earnings per day using this scheme. But what if you receive minimum wage for your work? How is sick leave calculated in such a situation?

In such cases, it is necessary to apply the minimum wage, that is, the value. Then the calculation and size of the minimum acceptable average earnings will look a little different.

Amount of insurance period (C%).

As it turned out, not only the average daily earnings calculated over the last two years of work have an impact on the amount of the benefit. Their size is also influenced by how many years of experience the employee has. Depending on the length of service, the percentage by which we multiply other values also depends.

Number of sick days.

The number of days you were forced not to work is written on your certificate of incapacity for work. To finally calculate the amount of benefits, you need to multiply all previously considered values by the number of days.

Please note: if you are sick or injured, the first 3 days of your absence will be paid by your employer, and the rest by the Social Insurance Fund. If the reasons for absence were different, then the Social Insurance Fund will pay benefits from the 1st day.

6 current situations from life, how sick leave is calculated

Despite the fact that we have fully analyzed the components of the formula, in order to calculate the allowance, we will look at examples of how to do this. We will present several standard and not so standard situations that you may need in your own calculations.

Example No. 1.

How is sick leave calculated as a general rule for an employee who works full time?

Let's say that a bank manager is sick and wants to receive compensation for the period when he is unable to go to work.

He was sick for 5 days.

The employee's experience is 9 years.

In 2016, he earned 700 thousand rubles, and in the previous year - 720 thousand rubles.

Let's calculate how much benefit he will receive. To do this, we first calculate the size of his average daily earnings: (700,000 + 720,000)/730 = 1945.21 rubles.

Now let’s transfer all the data into the formula and find out how much the bank manager can compensate. At the same time, we remember that due to long experience we will take into account 100% of average earnings.

1945.21*100%*5 = 9726.05 rub. – this is exactly the amount of compensation the manager will receive for his forced break from work.

Example No. 2.How are sick pay calculated for an employee who has worked very little and whose experience is less than six months?

It also happens that a new employee who has just started a job is sick. In such situations, remember that the amount of the benefit cannot be more than the minimum wage for 1 calendar month, and the sick leave itself will be calculated based on 60% of the average daily earnings. Let's calculate using an example.

The new accounting assistant got a job 3 months ago. Unfortunately, the weather was cold and she caught a cold, which left her sick for 9 days.

How is sick leave calculated in such a situation?

First, let’s remember how much the minimum wage is and what the minimum daily wage is. We will not take into account the previous two years of work, since they simply do not exist.

Example No. 3.

How are sick leave calculated when earnings for previous years amounted to a very small amount?

Low-paying jobs are unfortunately not uncommon today. Because of this, sometimes employees’ annual earnings are so low that they don’t even reach the national minimum. This is especially true for those who have changed several jobs in a year or have been unemployed for a long time.

Let’s imagine a situation: an employee of the company fell ill and spent 6 days on sick leave. His experience is not long yet - only 5 years. And earnings for previous years were: in 2016 - 112 thousand rubles, and in 2017 - 113 thousand rubles.

Let's start by calculating his average daily earnings: (112,000 + 113,000)/730 = 308.22 rubles.

It turns out that we receive an amount that is lower than the minimum established by law. How is the benefit amount calculated in such circumstances?

According to current laws, in such situations it is necessary to use the minimum amount of average income, that is, 367 rubles.

Then the amount of the benefit will be: 367*80%*6 = 1761.60 rubles.

Example No. 4.

How is disability benefits calculated if a sick employee violates the regime?

Situations where an employee actually left work for a while to undergo treatment, and at that time violated the regime, are very common. And the law established a rule for such sick employees: if an employee, while undergoing treatment, violated the regime, and the doctor made a note about this, then from the moment of violation of the regime, the sick person will receive benefits based on the minimum wage in the country.

Let's explain this with a simple example: a plant engineer went on sick leave for 10 days. Of these 10 days, he spent 4 days in the hospital, after which he violated the regime. The doctor naturally made a note about this.

The employee's length of service is 10 years, and the total amount of money earned for 2016 and 2017 was 1,300 thousand rubles.

Since the engineer complied with the regime for 4 days, his financial compensation for these days will be calculated according to the “standard” formula:

1780, 82*100%*4 = 7123.28 rubles.

The remaining 6 days of illness due to violation of the regime will be calculated differently:

367*100%*6 = 2202 rub.

This happens infrequently, but still in rare cases, conscientious employees holding high positions receive very high salaries, which exceed the amount allowed when calculating the average daily earnings.

Then you need to take into account that the law does not allow exceeding such a limit, and the benefit will still be calculated from the maximum allowable amounts.

Let's imagine that one of the directors of a large enterprise was injured, as a result of which he was forced to undergo treatment for 14 days.

His experience has already exceeded 15 years, and his income for 2016 and 2017 amounted to 730 and 760 thousand rubles. respectively.

It turns out that both the first and second total earnings for the year exceed the limit. This means that sick leave for the director will be calculated based on the maximum average income per day. Let us remind you that it is 2017.81 rubles.

In total, for his 14 days of illness, the employee will receive benefits in the amount of:

2017.81*100%*14 = 28,249.34 rubles.

Example No. 6.

How is compensation calculated for sick people if they work part-time?

Nowadays, quite often you can get a job where instead of an 8-hour working day, for example, a 4-hour day is established. In such cases, sick leave will be calculated using the same formula, but with time adjustment.

The editor of a small publication works every day except weekends, but only for 4 hours. In winter, the employee fell ill and was treated for 8 days.

Her experience is 7 years. Her earnings for 2016 amounted to 134 thousand rubles, and for 2017 – 135 thousand rubles.

First, let's see how her daily income will be calculated. It will be: (134000+135000)/730 = 368.49 rubles.

Now let's adjust this figure relative to the length of the working day. If it is 4 hours instead of 8, then we get: 368.49/8*4 = 184.25 rubles.

Having all the necessary components, sick leave will now be calculated as follows:

184.25*80%*8 = 1179.20 rub.

We looked at the most common situations, how temporary disability benefits are calculated. It is worth noting that sick leave is always calculated not for missed work, but for calendar days.

Now let’s talk about another question from this topic - how sick leave for pregnancy and childbirth is calculated.

From this video you will learn how to correctly calculate sick leave.

On the one hand, sick leave for pregnancy and childbirth is calculated according to a similar scheme to regular disability benefits. But in reality there are differences between the calculations, and they are very significant.

The main difference lies in the formula itself by which funds are paid:

As you can see, the formula is very similar to the previous one, but one element is missing here - the insurance period.

The fact is that when calculating maternity benefits, length of service does not matter. Only average earnings for the last 2 years are taken into account, taking into account the deduction of days of incapacity for work, as well as the number of days of incapacity for work.

By the way, the number of days allotted to women for pregnancy and childbirth can be:

- 140 days – if the birth was easy.

- 156 days – if complications arise during childbirth.

- 194 days - if several babies were born at once.

As for calculating the average daily income, as a general rule it should not exceed the established limits, and also should not be below the minimum threshold.

Since the insurance period is not taken into account, for working women it is 100% by default. But if a woman has too little experience - up to 6 months, then the amount of the benefit will be calculated based on the minimum wage.

Let's give an example of a standard situation. An airline employee went on maternity leave. Due to the birth of twins, it lasted 194 days. Previously, she worked full time, and for 2016 and 2017 she received a total salary of 315 thousand rubles.

The average daily income for her is 431.51 rubles.

The total amount of maternity benefits or, more simply put, maternity benefits will be:

431.51*194 = 83,712.94 rubles.

As you can see, such benefits are calculated quite simply, but there are some other features.

Let us remind you that this calculation applies only to working women whose work experience already requires two years of calculation.

If there is no experience, then the benefit is calculated only based on the minimum wage.

If a woman went on maternity leave while she was a student, then the amount of payments for her will be equal to the scholarship. In cases of compensation for female military personnel, maternity benefits will correspond to the amount of allowance.

Women laid off due to the liquidation of an organization can also apply for benefits. They are entitled to 300 rubles.

Special attention should be paid to situations where women work in parallel at two jobs, part-time. If this type of work is carried out over many years, then the benefits are due to female workers from both employers.

Let's summarize what has been said...

We analyzed how sick leave is calculated for employees of the Russian Federation and provided the most relevant examples of situations. In order to independently calculate the amount of the benefit due, substitute your numbers into the formula. This way, in a matter of minutes, you can calculate what the amount of compensation will be in your case.

A sick leave certificate confirms the fact that an officially employed person is incapacitated due to personal illnesses or illnesses of relatives.

A certificate of incapacity for work is issued to a citizen who has applied for assistance in treatment at a medical institution, and who at the same time has a document confirming the availability of insurance.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

(Moscow)

(Saint Petersburg)

It's fast and for free!

Legislative regulation of the issue

Based on a certificate of incapacity for work, an employee has the opportunity to receive financial benefits. It is assumed that these funds will be spent by the employee or his family members on necessary treatment.

The issuance of sick leave is regulated by the legislation of the Russian Federation. Payments are made on the basis of special calculations, in accordance with regulatory documentation in the form of Instructions and Regulations.

Each type of sick leave has its own regulations. The fundamental document is the “Regulations on compulsory social insurance”.

When is it necessary to register it?

Sick leave issued subject to conditions:

Certificate of incapacity for work issued in cases:

- employee illness;

- domestic or work injury;

- child's illness;

- necessary care for close relatives due to their illness;

- postoperative recovery;

- preparation for childbirth and recovery after it;

- after-care in Russian sanatoriums.

Registration procedure

In order to prevent forgery of sick leave certificates, special bluish-colored forms with barcodes, watermarks with a logo and microtexts were introduced.

When filling out the document there are certain rules and regulations:

- filling out the form is allowed in legible handwriting with printed characters, without corrections and only in black pen;

- all data is entered by employees of the medical institution and the enterprise where the sick person works;

- If incorrect information is entered into the form, it is considered invalid; in such a situation, a new document must be drawn up.

Employer representatives are required to fill out the information in the form:

After filling out the form, the employer must put his signature, certify it with a seal and submit the document to the accounting department for calculating payments and notifying the Social Insurance Fund.

From what funds is the amount for sick leave formed?

The amount of sick leave benefits is formed from several funds, depending on the type of sick leave issued.

3 days, starting from the day of opening the initial certificate of incapacity for work, are paid at the expense of the enterprise. In this article, there are restrictions on the validity of this paragraph only for sick leave issued on the basis of illness or injury of the employee himself.

3 days, starting from the day of opening the initial certificate of incapacity for work, are paid at the expense of the enterprise. In this article, there are restrictions on the validity of this paragraph only for sick leave issued on the basis of illness or injury of the employee himself.

The rest of the period of incapacity is paid at the expense of the Foundation.

When registering sick leave to care for family members, a child, or for follow-up treatment in a sanatorium, sick leave is paid from the first day of incapacity for work from the Social Insurance Fund.

Procedure and rules of calculation

The amount of benefits accrued on the basis of the provided certificate of incapacity for work depends on the employee’s length of service and his salary. Its dimensions are not limited to any fixed size.

Calculation of payments based on a sick leave certificate, is carried out in several stages:

Calculation example

Let's look at the example of calculating benefits for an employee of the enterprise, Andrey Vitalievich Fedorov, who was undergoing treatment from January 11 to January 25, 2019. Payments are calculated based on accrued wages for the period 2017-2018.

When determining wages for the billing period, it was revealed that the employee was accrued 780,000 rubles, of which in 2017 - 360,000 rubles, and in 2018 - 420,000 rubles.

Fedorov’s average daily earnings are 1,068.49 rubles. The value was obtained based on a calculation period of 730 days.

Definition average daily benefit taking into account work experience. Due to the fact that the employee’s work experience is 7 years, he is entitled to the amount of benefits accrued for sick leave in the amount of 80% of the previously calculated average daily earnings. The daily benefit amount corresponds to 854.79 rubles.

The calculation of the final amount that is due to be accrued to the employee who provided sick leave is made based on the number of days of incapacity for work.

Fedorov is entitled to 12,821.85 rubles.

Features of calculation in some situations

A long period

If an employee is sick for a long time, then, as a rule, he is issued several sick leaves for one insured event, one is primary, all the rest are continued.

Calculation of accruals is carried out simultaneously for all certificates of incapacity for work.

Calculation of accruals is carried out simultaneously for all certificates of incapacity for work.

Billing period determined based on the date of opening of the primary sick leave.

3 days are paid at the expense of the employer only for primary sick leave, all other days are paid at the expense of the Social Insurance Fund.

When changes in disease diagnosis When two primary sick days are presented to the accounting department of the enterprise, the employer is obliged to consider them as 2 insured events, for each of which the employee must be paid at the expense of the enterprise for 3 working days. The rest of the period is paid by the Fund.

When determining the average salary, periods of annual leave and sickness are not taken into account.

If the employee’s illness is long-term, then his sick leave may be submitted for payment even in a situation where the incapacity for work still continues.

Part-timer

The labor legislation of the Russian Federation provides several situations, on the basis of which sick leave benefits can be calculated and paid to a part-time worker:

- When holding a combined position for more than 2 years, the employee can count on receiving compensation from all jobs.

- If a part-time worker has changed either his main job or his combined job over the course of two years, then, according to the law, payments will be made only at one workplace, which is chosen at the discretion of the employee.

- If the length of service at the main place of work exceeds 2 years, and at the combined place of work - less than 2 years, then when calculating compensation for the main type of activity, the earnings accrued to him during the combination are taken into account.

- If the work experience of a part-time worker does not exceed 6 months, then the calculation of sick leave benefits is calculated based on.

The procedure for providing sick leave at the enterprise and calculating the accrual of benefits is different for employees working on external and internal part-time jobs.

For internal part-time worker:

- To calculate the payment for sick leave, it is enough to provide one sick leave certificate to the accounting department of the enterprise;

- when calculating sick leave benefits, the length of service in the main activity and combined activities is summed up;

- The calculation takes into account the employee’s average earnings, consisting of his total income from his regular and combined salary.

For external:

For external:

- to receive compensation at all workplaces, you must present a sick leave certificate for each;

- when performing work duties for more than 2 years, the employer is obliged to provide the employee with compensation paid along with the next salary;

- if the employee has worked part-time in an organization for less than 2 years, when an employee chooses a specific enterprise to provide sick leave, he must provide certificates from all other places of work stating that payments were not accrued or paid.

Compensation for an internal or external part-time worker is calculated based on the employee’s average earnings and insurance coverage.

For determining the amount of compensation the average income for a certain period of time should be established.

To do this, you need to take into account all types of accrual:

- salary;

- bonuses;

- compensation;

- material aid;

- other payments.

Calculation of compensation and its payment are carried out only on the basis of the original certificate of incapacity for work. Therefore, in order to pay for it in several organizations, the required number of documents should be issued at the medical institution.

Maternity leave

The maternity leave certificate is calculated based on the average earnings received by an employee of the organization for the 2 years preceding pregnancy. In this case, all payments from which contributions to the Social Insurance Fund were withheld for the billing period are taken into account.

Maternity benefits fall into the category of lump sum payments.

Maternity benefits fall into the category of lump sum payments.

On its size influence:

- duration of sick leave;

- the number of non-working days due to illness taken into account in the billing period;

- average earnings.

Payment for maternity sick leave is carried out based on the average daily earnings determined for the billing period and the number of days of incapacity for work, in accordance with the sick leave. The billing period is usually 2 years, which corresponds to 730 or 731 days. In this period, days of illness, in accordance with the certificate of incapacity for work, and being on parental leave are not taken into account.

The duration of a woman’s work in the organization at the time of issuing sick leave does not affect its payment. After working even for a few days, she will receive sick leave benefits. If a woman’s insurance period is more than 6 months, then the benefit is calculated based on 100 percent of the average salary.

For work experience of less than 6 months, benefits are calculated based on the minimum wage, which in 2019 is 11,280 rubles.

Maternity sick leave is also paid to foreign citizens who work at enterprises of the Russian Federation.

Existing restrictions on the amount of payment

Sick leave benefits are limited minimum and maximum sizes. Benefits cannot be less than the minimum wage. Maximum payment amounts are set annually based on recalculation of the minimum wage.

The rules and procedure for calculating sick leave are presented in the following video: